COVID Scorecard: Spotlight On Mortgage Forbearance

[Click here to download a PDF of our analysis]

Why this is important:

While forbearance rates have recently stabilized, serious mortgage delinquencies are now at a 10-year high and foreclosures have ticked upward. But with the CARES Act expired and unemployment remaining at historic levels, a severe housing crisis is at our front door. This has prompted the Committee for Better Banks to issue a Spotlight on Forbearance Post-CARES Act as the next report of our Better Bank Accountability Project because forbearance has been misunderstood, poorly implemented and a source of stress for both bank workers and customers.

Millions of Americans are increasingly worried how they will keep a roof over their head while bank workers are responsible for handling these fears every day. Without new federal legislation, the expiration of eviction and foreclosure moratoriums plus the end of $600 per week enhanced unemployment insurance benefits could be a perfect storm causing financial disaster. An estimated 25 to 30 million Americans are without a paycheck, roughly one in six people who had a job before the pandemic. Quick job growth seems like a pipe dream, leading more economists to describe our economic recovery as K-shaped where those at the top increase their wealth and position while regular Americans see their fortunes further degrade.

What we found:

We analyzed consumer complaints to the Consumer Financial Protection Bureau (CFPB) and reviewed bank policies on forbearance and foreclosures. Details of our investigation are in the Appendix.

- Eight(out of twelve) banks offered only forbearance in their stated policies, instead of also offering deferred payments and loan modifications (see the Appendix for further explanation of terms).

- Eight (out of twelve) banks originating mortgages had customers file complaints to the CFPB of being offered only forbearance starting at 90-days with balloon payments at the end of the forbearance period. Note: the list of banks only offering forbearance and having consumer complaints filed with the CFPB are not identical

- Fifth Third, Bank of America, Citi, Santander, and Wells Fargo are the only banks with explicit public policies extending a moratorium on evictions and foreclosures.

- Customer complaints to the CFPB that Wells Fargo, Bank of America and US Bank did not inform customers they would be unable to refinance their mortgage once placed in forbearance.

- Customer complaints to the CFPB that both HSBC and Wells Fargo placed customers in forbearance without their authorization.

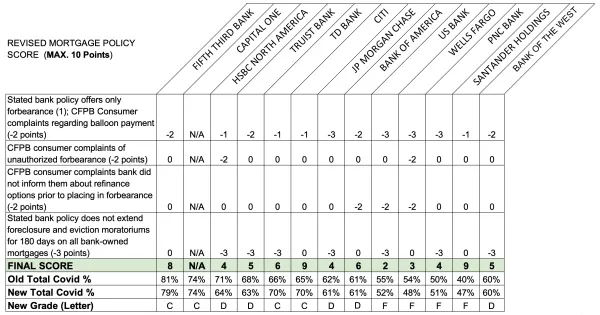

Impact Spotlight on Forbearance had on overall COVID-19 Response Bank Scorecards

On this issue of forbearance:

- Citibank and Santander stood above their peers with scores of 9 out of 10 possible points. Fifth Third also performed well with a score of 8 out of 10.

- US Bank and Wells Fargo were at the bottom of the pack with a score of 2 and 3 respectively.

- The new forbearance score raised the overall COVID-19 Response grades for two banks - Citibank and TD Bank - from D’s to C’s.

- The new forbearance score lowered the overall COVID-19 Response grades for two banks: In spite of Fifth Third Bank performing well, its overall grade went from a B down to a C. HSBC’s grade went from a C down to a D..

Bank Responses

The Committee for Better Banks presented its findings to each of the banks it analyzed for this study. Three banks provided substantive responses: Bank of America, Fifth Third Bank and Truist. Fifth Third and Truist provided new information that changed their mortgage grades. Fifth Third’s actions raised its final score to an 8 from a 4. Truists actions raised its score to a 5 from a 4.

- Fifth Third provided additional information about its forbearance program. According to Fifth Third, it “does not require customers at the end of the forbearance period to make a balloon payment, but instead provides them different options that best address their financial circumstances.”

- Fifth Third Bank also announced (and we verified) it had recently updated its website changing its policy on foreclosures; extending the suspension of initiating new foreclosures on homes through December 31, 2020.

- Truist Bank provided additional information about its forbearance program that included deferral options that move the balloon payment to the end of the loan rather than the end forbearance period. Truist also notified us that it had a previously non-public policy against foreclosures and evictions. According to Trust, “Truist voluntarily implemented a moratorium as to occupied bank-owned (non-federally backed) loans in March, at the same time that we implemented the CARES Act’s moratorium for federally backed mortgages. While the CARES Act moratorium provision has expired, Truist has generally extended its moratorium for bank-owned properties through the end of the year consistent with the moratorium extensions announced by the GSEs, FHA and VA. We did not advertise or publish these actions because clients are not required to do anything to have their foreclosure action suspended. Clients in foreclosure would be aware by: 1) contacting us, 2) contacting our or their counsel, or 3) by foreclosure sales being cancelled or the lack of other notices regarding progress. We also are consistent in complying with the various state and local foreclosure and eviction ordinances.” Since our score is based on publicly stated bank policies, this approach to handling potential foreclosures did not change its score for that category.

While Bank of America provided a substantive response, it did modify its stated public policies that would change its score under the spotlight on forbearance. It was already one of only 5 banks (after Fifth Third changed its policy) that has suspended foreclosures: “Due to the coronavirus, we have paused foreclosure sales and evictions of occupied properties..” [Bank of America, 8/22/20]

Recommendations on Forbearance and Suspending Foreclosures:

- All banks should offer all customers mortgage forbearance options that include deferred payments extending the term of the loan instead of a balloon payment at the end of the forbearance period.

- All banks should announce policies extending default, foreclosure, and eviction moratoriums for at least the next 180 days.

- Inform all customers requesting forbearance that it will prevent them from being able to refinance their mortgage.

- Improve internal safeguards to prevent customers being put into forbearance without their authorization.

Appendix

Methodology and Definitions

We searched the Consumer Financial Protection Bureau’s (CFPB) Consumer Complaint Database for complaints submitted from March 25 through August 13 regarding forbearance-related issues. We analyzed 191 consumer complaints against the 13 large retail banks in our study. The banks in our study were Bank of America, Bank of the West (BNP Paribas), Capital One, Citibank, Fifth Third Bank, HSBC North America, JPMorgan Chase, PNC Bank, Santander Holdings, TD Bank, Truist Bank, US Bank and Wells Fargo.

Homeowners are typically able to access several forms of hardship relief for mortgage payments that allow them to stay in their homes. This includes payment suspension in the form of forbearance or deferment and reduced payments from loan modification or refinancing agreements. Foreclosure alternatives such as a short-sale or deed-in-lieu-of-foreclosure require homeowners to vacate the home and either sell their property or return it to the bank. Our analysis examined the full breadth of relief that banks offered customers specifically for covid-related financial hardship using the following definitions:

Forbearance: Mortgage forbearance is a type of payment suspension where mortgage servicers or lenders allow borrowers to pause or reduce payments for a defined period of time. This is followed by a lump-sum or balloon payment at the end of the forbearance period.

Deferment: Deferment is another type of payment suspension where mortgage servicers or lenders allow borrowers to pause repayment for a defined period of time and repay over time.

Loan modification: A loan modification is a change to the terms of the original mortgage. This could include extending the number of years of the mortgage, the interest rate, or a reduction in the principal balance.

Short sale: A short sale occurs when homeowners sell their homes for less than the outstanding balance owed on the mortgage.

Deed-in-lieu of foreclosure: A deed-in-lieu of foreclosure arrangement is a process by which the homeowner voluntarily turns over their home to the lender to avoid foreclosure. Depending on local laws, the homeowner may still be liable for the balance owed to the lender if the home value is less than the mortgage.

Refinance: Refinancing is the process by which homeowners take out a new loan to repay the existing mortgage. This is commonly done to benefit from lower interest rates or borrow money.

Reinstatement: Mortgage reinstatement is an agreement in which homeowners who are delinquent on mortgage payments can repay the entire outstanding balance to bring the mortgage current.

Repayment plan: Repayment plans allow homeowners to bring their mortgage current by repaying the delinquent amount over an agreed upon period of time.

Scoring Details and Excerpts from CFPB Complaint Data for each Bank

Bank of America

Bank of America Stated Policies For Deferral And Forbearance Depended On Loan Status And Loan Owner Or Insurer Policy. “The owners or insurers of your loan will determine if you get payment deferral or payment forbearance: If we own your loan, we may be able to provide you a payment deferral or a payment forbearance. The Bank of America Payment Deferral Program is available for customers who have only one payment due on their loan. We'll defer three payments and extend the term of your loan by three months. The Bank of America Payment Forbearance Program is available for customers who have more than one payment due on their loan (for example, one missed payment and one payment currently due). We'll work with you to understand your specific needs and recommend a forbearance period of three months. If a third party owns your loan (e.g. Fannie Mae, Freddie Mac) or if your loan is insured by a third party (e.g. Federal Housing Administration), we will follow their guidelines and offer you a payment forbearance. Under a payment forbearance, we'll work with you to understand your specific needs and recommend a forbearance period of either three or six months.” [Bank of America, 8/13/20]

Bank of America Paused Foreclosure Sales And Eviction of Occupied Properties. “Due to the coronavirus, we have paused foreclosure sales and evictions of occupied properties… If you want to avoid foreclosure, please contact us immediately … and we'll discuss your options. There are programs that may allow you to stay in your home as well as options that might help you leave the house without going through foreclosure. The sooner you call us to explore your options, the more alternatives you may have.” [Bank of America, 8/22/20]

CFPB Received Complaint About Balloon Payments Under Bank of America’s Forbearance Program. According to CFBP complaint 3598132, “Bank of America is allowing Mortgage Forbearance but they are requiring XXXX, XXXX and XXXX 's payments due with the XXXX payment. It is impossible to be able to pay back all four months in XXXX. They will not put the three months at the back end of the loan. New York Department of Financial Services is looking into this but said that their regulatory authority is limited with Bank of America because Bank of America is not licensed in New York. They told me to contact you.” [CFPB Complaint Database, Accessed 8/13/20]

CFPB Received Complaint That Consumer Was Not Told Forbearance Or Deferral Program Would Impact Refinance Options. According to CFBP complaint 3712062, “Bank Of America Mortgage Account number XXXX Hi, I spoke to a rep and I have a 6.625 % interest rate- I asked to refinance and they said I could not because I am in a DEFERMENT program. Rates are very low and it would help me out along with me reading that banks are offering to streamline refinance consumers. I need help getting this process started- I have a great credit score and should be able to take advantage of the low interest rates.” [CFPB Complaint Database, Accessed 8/13/20]

Bank of the West

CFPB Received Complaint About Balloon Payments Under Bank of the West’s Forbearance Program. According to CFPB Complaint 3665012, “Covid 19 CARES Act clearly states mortgage servicers are required to provide 180 days mortgage payment relief and another 180 days mortgage payment relief upon request without penalty or accrued interest. On XX/XX/2020 requested mortgage payment relief for 180 days. On XXXX BOTW confirmed their offer of 90 day forbearance mortgage payment relief with balloon payment due at the end of the 90 day period. On XX/XX/2020 requested 180 days minimum with 1 year payment relief without penalty, interest accruement or balloon payment.” [CFPB Complaint Database, Accessed 8/13/20]

Bank of the West Website States Four Options At End of Forbearance Period: Lump Sum, Repayment, Loan Modification, and Deferral. “The assistance programs we offer, including those for federally-backed loans associated with the federal CARES Act, are payment forbearance. Forbearance is not forgiveness, but rather a temporary pause of your monthly mortgage payment. When your forbearance period ends, the payments you skipped during the forbearance need to be paid. Generally there are three types of options and we will work with you to determine your best solution. For any option other than the lump-sum payment, you must apply for further assistance and qualify. Not all borrowers will qualify for post-forbearance assistance… We encourage borrowers start with a 3-month (90-day) forbearance period, and not go longer until they know they need it. Those with federally-backed mortgage loans subject to the CARES Act are eligible to request up to 6 months (180 days) of payment relief, with the possibility of requesting up to an additional 180 days if they can affirm their COVID-19 financial hardship continues.” [Bank of the West, accessed 8/22/20]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database About Unauthorized Foreclosure Or Failure To Disclose Impact Of Forbearance On Refinance Options At Bank Of The West. [CFPB Complaint Database, Accessed 8/13/20]

Bank Of The West Website Did Not State Policy Against Foreclosure, Explained That “Foreclosure And Other Legal Proceedings May Be Suspended” During Forbearance Period. [Bank of the West, 8/22/20]

Citibank

Citi Policy Offered 90-Day Forbearance. “Citi's mortgage sub-servicer Cenlar FSB is offering 90-day forbearance for Citi's mortgage loans where the borrower is experiencing hardship, during which there will be no negative reporting to the credit bureaus for up-to-date customers. In addition, foreclosures and evictions have been paused.” [Citibank, 8/13/20]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database About Balloon Payments Under Citibank’s Forbearance Program. [CFPB Complaint Database, Accessed 8/13/20]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database About Unauthorized Foreclosure Or Failure To Disclose Impact Of Forbearance On Refinance Options At Citibank. [CFPB Complaint Database, Accessed 8/13/20]

Citi Paused Foreclosures And Evictions. [Citibank, 8/13/20]

Fifth Third Bank

Fifth Third Offered Mortgage Forbearance Policy, but does not require balloon payments. “‘Up to 180-day payment forbearance which may be extended up to an additional 180 days at the borrower’s request. In addition, the forbearance can be shortened at the borrower’s request.” [Fifth Third, 8/13/20]

CFPB Received Consumer Complaint About 90-Day Balloon Payment Under Fifth Third Bank’s Forbearance Program. According to CFPB Complaint 3579560, “Over the last week and a half, I have called and spoke with Fifth Third Mortgage 3 times. Most recently I had a conversation around XXXXXXXX XXXX EST. I informed them that I was aware that XXXX XXXX ( who my loan is associated with ) was urging service providers ( in my case Fifth Third ) to defer payments up to 12 months. My husband and I are XXXX XXXX people in the XXXX industry and not only has our cash flow immediately halted, but we are hemorrhaging money with refunds due to cancellation relating to COVID-19 and travel restrictions. Although we were being proactive anticipating this hardship I was informed by Fifth Third that I only had one option : To defer my payments for 3 months at which time they will ask me to pay the 3 months back in a lump sum ( {$4200.00} in my case ), and if unable they will address it or modify my loan. I can state with certainty that even if my businesses bounces back and we can operate within 3 months that we will not be in a position to pay {$4200.00} nor is modifying my loan an option. I'd like to know why Fifth Third is not following the instructions from XXXX.” [CFPB Complaint 3579560]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Unauthorized Foreclosure Or Failure To Disclose Impact Of Forbearance On Refinance Options At Fifth Third. [CFPB Complaint Database, Accessed 8/13/20]

Fifth Third Updated its Website to Show it has extended its suspension on foreclosures on homes through December 31, 2020. [Fifth Third, Accessed 9/18/20]. Prior to August 31, 2020, its website Did Not Show A Policy Against Eviction Or Foreclosure Past August 31, 2020. [Fifth Third accessed 8/22/20]

HSBC North America

HSBC Offered Only Forbearance For Homeowners. “For mortgage and home equity accounts, we’re offering assistance with your payments – we can defer your payments during the COVID-19 related financial hardship and waive late fees. Our payment deferral program is a forbearance, which provides temporary relief by suspending your regular monthly payment. The length of the forbearance depends on your situation. For a financial hardship due to COVID-19, the forbearance period is typically 90 or 180 days, but we may extend up to 360 days at your request.” [HSBC, 8/13/20]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Balloon Payments Under HSBC’s Forbearance Program. [CFPB Complaint Database, Accessed 8/13/20]

CFPB Received Consumer Complaint Of Unauthorized Forbearance At HSBC. According to CFPB Complaint 3662183, “HSBC FRAUD - I contacted HSBC around XX/XX/2020 and INQUIRED about a mortgage forbearance but mentioned I did not need it at this time. I received a confirmation letter in the mail on XX/XX/2020 and did NOT sign it and emailed it to HSBC and let them know I did not need it. However, I found out around XX/XX/2020 that I was put on the forbearance without my knowledge. I have since called and emailed and have not received any information or response back. This was without my knowledge and HSBC should be reprimanded.” [CFPB Complaint 3662183]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Failure ToDisclose Impact Of Forbearance On Refinance Options At HSBC. [CFPB Complaint Database, Accessed 8/13/20]

HSBC Coronavirus Information Center Website Did Not State Policy Against Eviction Or Moratorium. [HSBC, accessed 8/22/20]

JPMorgan Chase

JP Morgan Offered 90 Day Forbearance. “Customers can delay up to three monthly payments on their mortgage or home equity line of credit if they tell us they’re affected and need help. They may be able to delay additional payments. We’ll also waive any associated late fees and suspend foreclosure activity during the assistance period.” [JP Morgan, 8/13/20]

CFPB Received Consumer Complaints of Balloon Payments Under JPMorgan’s Forbearance Program. According to CFPB Complaint 3598430, “I lost my job in the middle of XX/XX/2020 and because of the COVID19 crisis I've had difficulty paying my mortgage. My mortgage is through Chase Bank. I've tried calling chase bank dozens of times but I can not get a hold of anyone willing to help or explain my options to me. I keep getting a recorded line that tells me the " only option they offer '' is a forbearance period of 3 months after which the ENTIRE unpaid loan balance along with the 4th month 's payment will be due. This means they offer the option of pausing mortgage payments for 90 days, and on the 91st day, the entire balance of the previous 3 months in addition to the 4th month 's mortgage payment is due. This is predatory and completely unreasonable as a forbearance option. This is clearly not a good faith option Chase bank is offering. Chase bank 's representatives has refused to discuss anything further with me and have stopped responded to my email requests at communication. As per the : Board of Governors of the Federal Reserve System Federal Deposit Insurance Corporation National Credit Union Administration Office of the Comptroller of the Currency Consumer Financial Protection Bureau statement made XX/XX/2020, this goes against the " good faith '' clause outlining bank 's responsibilities to offer " good faith '' options for borrowers struggling with the COVID19 situation.” [CFPB Complaint 3598430]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Unauthorized Foreclosure Or Failure To Disclose Impact Of Forbearance On Refinance Options At JP Morgan Chase. [CFPB Complaint Database, Accessed 8/13/20]

JP Morgan Chase Website Did Not State Policy Against Eviction, Limited Policy Against Foreclosure To Mortgage Forbearance Period. [JP Morgan Chase, accessed 8/22/20]

PNC Bank

PNC Bank Offered 90-Day Forbearance Option. “If you are experiencing a financial hardship and unable to make payments on your mortgage due to coronavirus, we are offering a temporary financial hardship payment forbearance option. You will not have to make your payments for an initial 90 days with the ability to extend for longer, if needed. Please complete and submit the mortgage hardship request form to be considered for this program.” [PNC Bank, 8/13/20]

CFPB Received Consumer Complaint Of Balloon Payment Requirement Under PNC Bank’s Forbearance Program. According to CFPB Complaint 3619615, “This complaint is about the CARES Act, Corona Virus mortgage relief program. As I understand, if I have a federally backed loan, I can apply for forbearance for up to 180 days. I have a XXXX XXXX owned loan serviced by PNC Bank. I applied for forbearance due to my salary being reduced during this pandemic. I was told the only forbearance available was to delay my payments for 90 days, but that all previous three months payments would be due at the end of the 90 days. That's not much of a relief.” [CFPB Complaint 3619615]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Failure ToDisclose Impact Of Forbearance On Refinance Options At PNC [CFPB Complaint Database, Accessed 8/13/20]

PNC Coronavirus Information Center Website Did Not State Policy Against Eviction Or Foreclosure. [PNC, accessed 8/22/20]

Santander Holdings

Santander Homeowner Assistance Program Included Forbearance And Short Sale. “Available Homeowner Assistance Programs: Refinance, Reinstatement, Repayment Plan, Forbearance Plan, Mortgage Modification, Short Sale, Deed-in-Lieu of Foreclosure.” [Santander Bank, 8/13/20]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Balloon Payments Under Santander’s Forbearance Program. [CFPB Complaint Database, Accessed 8/13/20]

CFPB Received Consumer Complaint About Forbearance Option at Santander. According to complaint 3579537, “ Hello! I have my home mortgage with Santander Bank, NA. Due to being laid off part time from my job due to the COVID 19 quarantine and lack of business, I fear that I will be unable to make full payments monthly to Santander Bank, NA for XXXX, XXXX or even any month after until we hopefully return to a better economy. But we are not guaranteed getting our jobs back either. When I called Santander Bank, NA at their Customer Service number to discuss options on XX/XX/XXXX, they were rude and had no plan or solution. I realize that they are also using leveraged monies, and have their needs, but if they could decrease the payments, or defer the payments somewhat for several months could be helpful, as Bank of America has done. Their customer service numbers are XXXX and XXXX. I have had this loan for one year and have made all previous payments on time, and do not want to fall behind or decrease my credit rating. Thank you so much.” [CFPB Consumer Complaint 3579537]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Failure ToDisclose Impact Of Forbearance On Refinance Options At Santander [CFPB Complaint Database, Accessed 8/13/20]

Santander’s Coronavirus Paused Foreclosure During Pandemic. “Please note that all foreclosure activity has been suspended through this national emergency.” [Santander, accessed 8/22/20]

TD Bank

TD Bank Offered Forbearance Option. “For mortgages, home equity loans and home equity lines of credit, TD is offering the option to enter into a forbearance plan, an agreement that allows a borrower facing temporary hardship to make no payment during the term of the plan.” [TD Bank, 8/13/20]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Balloon Payments Under TD Bank’s Forbearance Programs. [CFPB Complaint Database, Accessed 8/13/20]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Failure ToDisclose Impact Of Forbearance On Refinance Options At TD Bank. [CFPB Complaint Database, Accessed 8/13/20]

TD Bank Coronavirus Updates Website Did Not State Policy Against Eviction or Foreclosure. [TD Bank, 8/22/20]

Truist

Truist Offered Mortgage Forbearance And Deferral Options. “Forbearance: Forbearance is like a pause button. It lets you suspend your monthly mortgage payments for a specific amount of time without incurring any penalties or late fees or being reported as delinquent to the credit agencies. Forbearance is generally where most people start with mortgage relief because no paperwork is required for requests related to COVID-19 and it’s easy to adapt to changing circumstances... At the end of your forbearance, you’ll work with a member of our home preservation team to develop a plan to repay the amounts that would have been due while you were in forbearance… If you have been in forbearance or missed mortgage payments, but have returned to financial stability, a payment deferral plan might be right for you. This requires some additional on your mortgage and return to making your regular monthly payments. A payment deferral will create a balloon payment at the end or maturity of your loan [not at the end of the forbearance period]. This balloon payment is the sum of your skipped payments and will be due all at once.” [Truist, 9/3/20]

CFPB Received Consumer Complaint Of Balloon Payment Under Truist’s Forbearance Programs. According to CFPB Complaint 3604600, “I want to apply for mortgage forbearance due to unemployment from COVID-19. The company SunTrust allows forbearance but a lump sum payment is due at the end of the forbearance period. This is silly, If I had the $ to pay a lump sum I would just continue to make payments. Where is an unemployed worker suppose to get a lump sum? Unemployment benefits are significantly delayed and are only a fraction of my normal payroll. This is predatory lending because they say we will see if you qualify for a re-finance afterwords. Really, another loan application with all the closing costs associated with that. This is not fair or should be illegal if the US govt. is going to help the mortgage companies to get through the forbearance period.” [CFPB Complaint 3604600]

As of August, 13, 2020, there are no published Complaints on the CFPB Complaint Database Of Failure ToDisclose Impact Of Forbearance On Refinance Options At Truist Bank. [CFPB Complaint Database, Accessed 8/13/20]

Truist Coronavirus Updates On Website Did Not State Policy Against Eviction or Foreclosure; Simply Stated “Foreclosure Relief.” [Truist, 8/22/20]

US Bank

US Bank Offered 180 Day Payment Suspension. “If the COVID-19 pandemic has affected your ability to pay your mortgage, we may be able to help. We’re offering assistance programs that may allow you to suspend payments for up to 180 days with no late fees.” [US Bank, 8/13/20]

CFPB Received Consumer Complaint Of Balloon Payment Under US Bank’s Forbearance Program. According to CFPB Complaint 3590717, “My husband list his job due to covid. He was laid off because his XXXX had to close down. I called US bank because I saw that mortgages through XXXX XXXX or XXXX XXXX were allowing banks to let homeowners defer payments up to 12 months. I also saw where many banks were allowing you to add the missed payments to the end of the mortgage. I called US bank twice thinking the first person I got was wrong. I called on XX/XX/XXXX and XX/XX/XXXX inquiring about covid assistance. The only option they gave me was to put my loan in a three month forbearance but said the entire amount would be due once the three months was up. I said that doesnt help at all because my husband is now jobless. We aren't going to magically have thousands of dollars in three months. I said I’ve heard other banks are allowing you to tack the extra payments on to the back end of the loan. They said they weren't doing that. I said this is not assisting us at all. They said that was my only option for assistance. As I said, I spoke to two different agents on two different days and they both said the same thing. I dont think it's right that the banks get help during this time but do not extend the same help to their customers. We’ve never been late or missed a single mortgage payment." [CFPB Complaint 3590717]

CFPB Received Consumer Complaint About Impact of Forbearance On Refinance Options at US Bank. According to CFPB Complaint 3643527, “I am XXXX XXXX and own a XXXX XXXX that works in the XXXX XXXX. Since early XXXX of 2020 we have not been able to generate income due to the shut down of large gatherings, and shelter in place order issued by the governor. As many families and small business owners in this position we began looking for ways to cut down on monthly expenses. The biggest of those being our Mortgage with US Bank. On XX/XX/XXXX2020 My wife and I called in to inquire about the forbearance program they were offering to help people with. Throughout my conversation we specifically asked the rep ( XXXX XXXX ) if our credit would be impacted, if we could refinance while in forbearance, and if we would be reported as making payments late. To which she informed us that our credit would NOT be affected, we WOULD be able to refinance while in forbearance, and then we would NOT be reported as missed/late payment on our mortgage. Upon speaking with a lender early the week of XX/XX/XXXX2020 I learned that not only can we NOT refinance while in forbearance, but they need to see 12 months of on time payments after the forbearance ends. Which means we now have to wait an entire year just to refinance. Our interest rate is currently at 5 %. Had we been given the correct information when we first called in we would NOT have chosen to put our mortgage in forbearance.” [CFPB Complaint 3643527]

US Bank’s Coronavirus Information Website Did State Policy Against Eviction And Foreclosure. [US Bank, accessed 8/23/20]

Wells Fargo

Wells Fargo Offered 6 Month Forbearance Program In Three Month Increments Plus 6 Month Extension To One Year For Loans Covered By CARES Act. “You can request an initial payment suspension — a temporary pause of your loan payments for up to 6 months. We will make this available in 3-month increments, checking in with you to understand if you continue to experience financial hardship. At the end of the initial 6 months, if your mortgage is covered by the CARES Act, you may request an additional 6 months of payment suspension for a total of 12 months in accordance with the CARES Act.” [Wells Fargo, 8/13/20]

CFPB Received Consumer Complaint Of Balloon Payment Under Wells Fargo’s Forbearance Program. According to CFPB Complaint “I have called by phone multiple times, emailed multiple times ( XX/XX/XXXX and XXXX and XXXX ) for which I have copies, and sent a written letter on XX/XX/2020 to my mortgage servicer, Wells Fargo Bank, requesting a 6 month forbearance under the CARES Act as I have had not income for nearly 2 months and my business has had a 90 % reduction in income due to the Pandemic. I know that XXXX XXXX owns my mortgage. I have been put on hold for hours, and had only form emails and letters in return none of which is in reply to my clearly expressed request for a 6 month forbearance. Wells Fargo has replied in a form letter that I will have a 60 day deferral at which time i will owe full back principal and interest as a balloon payment. I do not have any other options to contact Wells Fargo and all attempts to communicate which have taken hours do not get me to a real person but only result in form letters that are not responsive to my direct request made with identifiers of my loan number and numerous ways to contact me.” [CFPB Complaint 3620059]

CFPB Received Consumer Complaints Of Unauthorized Forbearance And Failure To Inform Customers About Impact Of Forbearance On Refinance Options. According to CFPB Complaint 3638239, “Last month in XXXX, my company gave us a 15 % salary reduction for the next 3 months. I was looking at my finances, and my bank Wells Fargo had a popup talking about COVID-19 and that I could put my mortgage on 3 month suspension, so I clicked thru and got it deferred - WellsFargo said on the site ( among other things ) : A short-term payment suspension temporarily pauses your obligation to make monthly payments for 3 months. During this time, we wont charge late fees or report additional missed payments to the credit bureaus. So, that was the beginning of XXXX. When my XX/XX/XXXX payment came up, I tried to make a payment to my Mortgage from my checking account, and i got a weird error message saying " no linked accounts can make a payment to this mortgage ''. I called WellsFargo, and asked them why I couldn't make a mortgage payment. They said it was because my mortgage was in forbearance. I asked them to remove that, because I can make my payments without any issues and it was a mistake to enable the forbearance. So on XX/XX/XXXX, I started shopping for a new mortgage, and am working with a mortgage broker ( MB ), who pulled my credit on XX/XX/XXXX, and told me to pay down a credit card ( which I did ), and he'll pull a new score. today, he pulled the new score, my score went up by 20 points and I'm in a great position for a new loan. Except there's a problem - WellsFargo sent an update to all 3 of the credit bureaus that my mortgage was in a 3 month forbearance - Deferred to XX/XX/2020 - and this is now listed on all 3 credit reports. My mortgage broker said this was a HARD STOP to my refinancing as they won't work with anyone with a forbearance on their mortgage. I called Wells Fargo and they said yes, they did remove the forbearance, and will be sending me a letter saying this. But my MB said he can't do anything with a letter. Wells Fargo will not do anything to remove this from my credit report ( called them twice today (XX/XX/2020 ) and both times got hung up on while on hold - but basically said said i have to wait until credit reports update next month. i am going to miss my window to refinance. anything i can do?” [CFPB Complaint 3638239]

Wells Fargo Coronavirus Website Stated Bank Paused Evictions And Foreclosures. “If you're experiencing a hardship or have other needs, we'll work with you. We're suspending residential property foreclosure sales, and evictions. Also, on a case-by-case basis, we're offering fee waivers, payment deferrals, and other expanded assistance for credit card, auto, mortgage, small business, and personal lending customers who contact us.” [Wells Fargo, 8/23/20]

Commitee For Better Banks letter to Fifth Third Bank

Commitee For Better Banks letter to HSBC

Commitee For Better Banks letter to Truist

Commitee For Better Banks letter to TD Bank

Commitee For Better Banks letter to CitiBank

Commitee For Better Banks letter to Capital One Bank

Commitee For Better Banks' letter to Bank of America

Commitee For Better Banks' letter to US Bank

Commitee For Better Banks' letter to Wells Fargo

Commitee For Better Banks' letter to JP Morgan Chase