Report: Sales Pressure Returns to Wells Fargo: Employees sound alarm on sales pressure, staffing, and silencing their voices

Committee for Better Banks

April 2025

Table of Contents

- Executive Summary

- Introduction

- About the Committee for Better Banks' Bank Accountability Project and CWA

- About Wells Fargo

- Wells Fargo's Illegal Sales Practices

- Wells Fargo's Consumer Complaints with the CFPB Have Grown Since 2018

- Carrots, Sticks, and the Operational Basis for Good Jobs

- Wells Fargo's Flawed Approach to Human Capital Management

- Investment in Human Capital Management and ROI

- Wells Fargo Policies, Metrics, and Training Materials Confirm Return of Sales Goals

- Workers are Reporting Returning Sales Pressures at Wells Fargo

- Sales Pressure is Compounded by Severe Understaffing and Other Sources of Stress

- Anti-Union Activity at Wells Fargo

- Wells Fargo Has Diverted Significant Company Resources Into Its Anti-Union Program

- Conclusion

- End Notes

Executive Summary

Since 2015, Wells Fargo’s decision not to invest in successful human capital management strategies has led to over 120 regulatory violations and related litigation, resulting in the bank paying over $14.8 billion in penalties.[1] Most of these penalties were related to a work culture and environment that cost retail banking consumers millions of dollars in improper charges. These were the consequences of excessive and abusive sales metrics and aggressive cross-selling that Wells Fargo executives adopted. When internal sales misconduct was identified, senior executives “lied to regulators” and even developed a “new way to calculate the volume of accounts it was opening for customers” in order to avoid investors asking questions about the bank’s sales practices.[2]

Evidence from a recent employee survey, other information from employees, an examination of customer complaints submitted to the Consumer Financial Protection Bureau, and predictions based on Wells Fargo’s financial reporting indicates that the problematic human capital management practices that led to the fake account scandal may be making a comeback:

- In 2021, we found a new troubling pattern emerge: a simultaneous rise in consumer complaints submitted to the Consumer Financial Protection Bureau[3] and a rise in incentive-based compensation,[4] compounded by a sharp reduction in branch staffing;

- Findings from a survey of workers indicate they are overwhelmingly concerned and stressed by the spectre of high-pressure sales goals returning;[5]

- Internal documents reveal that management has recently informed workers in sales activity roles that sales goals are returning,[6] while managers refer to “sales” as “outcomes;”[7]

- Wells Fargo is more reliant now on incentive pay than at any point since the scandal broke;[8]

- The volume of consumer complaints filed against Wells Fargo continues to exceed those received prior to the 2018 Federal Reserve asset cap Order;[9]

- Bank employees complain about understaffing while pointing to compliance procedures that paradoxically constrain their ability to serve customers while focusing interactions excessively on generating new sales;[10]

- Management has further increased stress on employees by diverting significant resources to actively oppose employee efforts to ensure equitable workplace practices by forming unions.[11]

As regulators consider whether or not to lift existing restrictions on Wells Fargo’s total assets, the Committee for Better Banks (“CBB”) argues Wells Fargo is far from having cured deficient human capital management practices. Wells Fargo seems only to have temporarily pulled back on punitive and coercive evaluation metrics. CBB found that incentive payments are nearly back to the same level of pay that prevailed before the fake accounts scandal in 2016.[12] Between 2002 and 2016, Wells Fargo pressured thousands of employees to meet sales goals to earn bonuses.[13] The practices resulted in millions of fake accounts being opened and customers being wrongly charged with overdraft fees. Most of these transactions were completed without customers’ knowledge, authorization, or consent.

Wells Fargo admitted to Federal Regulators that it collected millions of dollars in fees and interest payments to which the Bank was not entitled, harmed the credit ratings of customers, and unlawfully misused customers’ private and sensitive personal information.[14] Wells Fargo subsequently agreed to a $3 billion fine by the United States Attorney General and the Security and Exchange Commission.[15]

In February 2024, the Office of the Comptroller of the Currency (OCC) lifted a consent order issued in 2016 related to sales practice misconduct.[16] Some signs point to a greater interest from regulators in lifting additional restrictions, including a current cap on the amount of assets Wells Fargo can accumulate.[17]

But today, Wells Fargo workers report an increase in practices similar to those that led to the fake accounts scandal. Increased sales pressure is only one part of the problem—workers report Wells Fargo is also degrading job and service quality by reducing staffing levels, connecting sales goals to incentive payments such as cash bonuses , and standing in the way of them organizing their union.[18]

Introduction

The fake accounts scandal that consumed Wells Fargo in the fall of 2016 made clear that workplace policies and practices—what investors refer to as “human capital management”—can have a decisive effect on a company’s reputation, regulatory compliance, and fair treatment of consumers. But the process of reforming Wells Fargo has been slow-going: the bank has repeatedly replaced CEOs, high-level executives, and members of the Board of Directors, in part because investigations repeatedly revealed more wrongdoing and more illegal practices at the company.[19]

The long and growing list of Wells Fargo’s regulatory violations revealed since the fake accounts scandal broke makes it clear that Wells Fargo’s problems run deep. In response to some of Wells Fargo’s problems, Federal Reserve Chair Jerome Powell declared that Wells Fargo will not escape regulatory purgatory until “significant progress in remedying its oversight and compliance and operational risk management deficiencies” has been made and the Board of Governors votes to remove the asset growth restrictions.[20] Nevertheless, the regulatory restrictions imposed on Wells Fargo in 2018, including limits on its ability to increase its total assets, have been gradually lifted. In a recent letter to Powell, U.S. Senator Elizabeth Warren expressed concern that the Fed may consider removing the asset cap despite clear evidence of ongoing problems with regulatory compliance and internal controls, including a September 2024 regulatory enforcement action focused on the bank’s inadequate anti-money laundering program.[21]

Worse still, evidence from employee surveys, customer complaints submitted to the Consumer Financial Protection Bureau, and from Wells Fargo’s financial reporting strongly indicates that the problematic human capital management practices that led to the fake account scandal are making a comeback:

- In 2021, we found a new troubling pattern emerge: a simultaneous rise in consumer complaints submitted to the Consumer Financial Protection Bureau[22] and a rise in incentive-based compensation,[23] compounded by a sharp reduction in branch staffing;

- Findings from a survey of workers indicate they are overwhelmingly concerned and stressed by the spectre of high-pressure sales goals returning;[24]

- Internal documents reveal that management has recently informed workers in sales activity roles that sales goals are returning,[25] while managers refer to “sales” as “outcomes;”[26]

- Wells Fargo is more reliant now on incentive pay than at any point since the scandal broke;[27]

- The volume of consumer complaints filed against Wells Fargo continues to exceed those received prior to the 2018 Federal Reserve asset cap Order;[28]

- Bank employees complain about understaffing while pointing to compliance procedures that paradoxically constrain their ability to serve customers while focusing interactions excessively on generating new sales;[29]

- Management has further increased stress on employees by diverting significant resources to actively oppose employee efforts to ensure equitable workplace practices by forming unions.[30]

The findings explored in this report indicate that Wells Fargo’s human capital management approach is clearly inadequate. Over the past decade, Wells Fargo was liable for over 120 regulatory violations and related litigation resulting in the bank paying over $14.8 billion in penalties[31]—harming millions of American families and being ordered to refund billions of dollars to consumers across the country.[32] These costs were the consequences of poorly conceptualized human capital management practices that executives implemented despite potential problems with their feasibility, fairness, or effect on customer service. Wells Fargo customers were not hit with improper and unlawful fees and charges because bank employees were lazy or distracted but because management persisted in believing that incentive pay improves efficiency, that individualized sales metrics were an appropriate basis for promotion or demotion, and that existing internal controls sufficed to inform executives and directors as to the impact of their policies on the workforce and thus the company.[33]

In fact, in 2013, while the fake accounts scandal was taking place, Wells Fargo officials claimed their incentive system had protections consistent with best practices for minimizing risk, including maintaining a whistleblower hotline and an ethics program to instruct bank employees on spotting and addressing conflicts of interest.[34] The bank’s leadership at the time acknowledged its strong focus on selling but said it was intended to benefit customers by identifying their needs. “I’m not aware of any overbearing sales culture,” Chief Financial Officer Timothy Sloan said in an interview in 2013.[35]

Fixing Wells Fargo will require management to do more than give assurances that the bank’s culture is reformed, particularly if workers are sounding alarm bells. Management must form a collaborative partnership with employees and their unions, in which employees have a real opportunity to shape compliance and reporting mechanisms, and only after such a partnership has been established should the remaining regulatory limitations be lifted.

This report proceeds as follows:

- Section 1 reviews Wells Fargo’s history of regulatory compliance, especially since the fake account scandal first came to light in 2016.

- Section 2 describes Wells Fargo’s model of human capital management and documents long-term changes that likely contributed to the fake account scandal, including declining human capital investment, deteriorating benefits, and increased reliance on incentives and commissions.

- Section 3 describes the results from surveys of Wells Fargo workers, who express increased concern over the evident return of 2016-era sales pressure, as well as staffing reductions.

- Section 4 describes the efforts by Wells Fargo employees to find relief by organizing unions and seeking to bargain over these workplace issues with the Company, and Wells Fargo’s response, which has resulted in the filing of at least 34 unfair labor practice charges, including a formal Complaint issued by the National Labor Relations Board against Wells Fargo.

About the Committee for Better Banks’ Bank Accountability Project and CWA

Ten years ago, the Communications Workers of America (CWA), a national labor union founded in 1938, formed the Committee for Better Banks[36] in an effort to improve employment practices in the financial service sector because of its historically low unionization rates in the United States. The U.S. is an outlier among industrialized countries, which typically have very high unionization rates in the retail banking sector.[37] Five years ago, CBB launched the Bank Accountability Project to raise awareness and hold America’s financial institutions accountable for their policies and practices that impact bank workers, customers, communities, investors, and other stakeholders. This project has issued scorecards grading banks on important issues of the day. Over the past year, CBB also launched the Wells Fargo Workers United campaign,[38] which has won a growing number of union elections to join CWA. CWA currently represents working people in telecommunications, customer service, media, airlines, health care, public service and education, manufacturing, tech, banking and financial services, and other fields.

About Wells Fargo

Wells Fargo Bank, N.A., is the third-largest bank in the United States,[39] holding approximately $1.7 trillion in total assets under management and serving millions of individual and corporate customers across four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.[40] The bank operates over 4,400 branches in 24 of the 30 largest markets in the U.S. and employs over 226,000 employees as of December 31, 2023.[41] Wells Fargo has been focused on growth ever since its 2009 acquisition of Wachovia, valued at $12.7 billion.[42] That merger allowed Wells Fargo to expand to what it is today, playing a crucial role in the security and stability of our national financial services sector. The bank’s priority on growth is precarious, considering the number of scandals it has faced in recent years. Alongside the widespread consumer abuses and compliance breakdowns associated with the fake accounts scandal, the bank has also lagged in pay and benefits for workers.[43]

Roles and Responsibilities at Wells Fargo

A growing number of Wells Fargo employees who work in both retail and “back of house” roles have formed Wells Fargo Workers United as part of CWA. A bank the size of Wells Fargo is a highly regulated and complex business with hundreds of job titles and functions. In this section, we introduce some of the occupations that keep Wells Fargo running.

Branch Network Occupations:

Tellers, also known as service employees, support face-to face customer interactions in each branch by processing transactions, sharing digital solutions, and completing various duties such as counting and reconciling cash drawers at the end of each day.[44]

Branch Operations Coordinators (formerly Lead Tellers) are responsible for performing routine to moderately complex tasks such as accurately processing and approving teller transactions, sharing digital solutions, and making appropriate introductions between customers and bankers. Coordinators usually have no direct reports and work to support Branch Managers with operational tasks and scheduling. Coordinators can also approve Teller transactions with higher cash limits and resolve issues related to daily operations of the teller line under the direction of regional banking management. In their roles, coordinators support customers and employees in resolving or escalating concerns or complaints.[45]

Bankers, also known as platform employees, hold various “client management” titles such as Associate Personal Banker, Premier Banker, Relationship Banker, and Small Business Banker. Each banker role operates within a broader referral and incentive structure designed to drive sales of deposit products and investment securities.[46] Associate Personal Bankers handle basic account services such as opening checking, savings, and certificate of deposit (CD) accounts; opening new lines of credit; and other simple service changes like updating addresses for customer accounts. For more complex tasks involving investments and securities, Associate Personal Bankers must refer clients to a licensed Relationship or Premier Banker. Relationship and Premier Bankers hold licenses under the Financial Industry Regulatory Authority, or FINRA, to discuss and recommend securities, investments, and other financial services to customers.[47] While their licenses technically allow them to make recommendations, Relationship and Premier Bankers are prohibited from recommending securities and investment products to customers. Instead, Premier and Relationship Bankers are incentivized to refer clients to Financial Advisors, who then recommend and finalize investment decisions. Small Business Bankers help clients open and maintain business accounts, manage deposits, and open business lines of credit. Like Associate Personal Bankers, Small Business Bankers must refer transactions involving investment products to licensed Bankers. Senior Premier Bankers have the added responsibility of primarily working with a dedicated section of the bank’s affluent customers and small businesses. They are responsible for collecting information directly from clients regarding their income and assets, investments, and credit accounts, as well as their family structure, occupation, and hobbies/interests, to tailor their sales conversations to them.[48]

Risk and Regulatory Compliance Roles:

Investigators in the Conduct Management Intake Department fall within the bank’s Business Risk Control and Regulatory Oversight division. The Conduct Management Intake Department was created after the fake accounts scandal erupted in 2016. Investigators are responsible for the intake, research, and documentation of all external and internal (i.e. customer and employee) allegations pertaining to the company. Investigators in this department are not centrally located, but have a presence in Arizona, California, Iowa, Missouri, Minnesota, North Carolina, Texas, and Virginia.

Wells Fargo’s Illegal Sales Practices

Between 2002 and 2016, Wells Fargo pressured thousands of employees to meet unattainable sales goals to earn bonuses and to keep their jobs. A core part of this sales model was the “cross-selling strategy” to sell existing customers additional products. There was widespread fear among workers that they would be retaliated against if they blew the whistle on sales misconduct.[49] These practices resulted in millions of unauthorized accounts, credit card accounts, and other banking services without customers’ knowledge or consent.[50]

Wells Fargo admitted to Federal Regulators that it collected millions of dollars in fees and interest payments to which the Bank was not entitled, harmed the credit ratings of customers, and unlawfully misused customers’ private and sensitive personal information.[51] Wells Fargo was subsequently fined $3 billion by the United States Attorney General and the Security and Exchange Commission.[52] The bank also entered into a Consent Order with the Office of the Comptroller of the Currency (OCC).[53] In 2018 the Federal Reserve Board of Governors placed Wells Fargo under an asset cap due to its “widespread consumer abuses and other compliance breakdowns.”[54]

Compliance breakdowns have continued for years after the asset cap was first imposed, including in 2021 when the OCC issued a consent order regarding its home lending loss mitigation program and violations of the 2018 Compliance Consent Order.[55] In the consent order, the Comptroller found that, “The Bank’s inadequate controls, insufficient independent oversight, and ineffective governance related to loss mitigation activities have caused the Bank’s failure to timely detect, prevent, and quantify inaccurate loan modification decisions and impaired the Bank’s ability to fully and timely remediate harmed customers.”][56]

In a recent annual report, Wells Fargo claims to have taken additional action to protect both customers and employers by creating a “company culture we can all take pride in”[57] and that the OCC’s decision to lift the consent order reflects that the Bank now operates much differently today around sales practices. Regulators have lifted some of the consent orders related to sales practice misconduct,[58] but new violations have also been identified. In September 2024, the OCC and Wells Fargo agreed to a new consent order that “identifies deficiencies relating to the bank’s financial crimes risk management practices and anti-money laundering internal controls.”[59]

Despite Wells Fargo’s public pledges to satisfy federal regulators enough to lift asset cap sanctions, workers report continued compliance breakdowns and a return of risks that were present leading up to the fake account scandal.[60] Workers in Wells Fargo’s conduct management group, employees responsible for researching internal and external allegations, have been laid off and have seen an increase in work outsourced abroad. Multiple workers within the Conduct Management department we spoke with expressed concern that internal investigators faced pressure to reclassify allegations so that cases do not get a formal review.[61] Managers overseeing the department can allegedly adjust the criteria that workers are told to use, which will determine whether a complaint (i.e., allegation) is determined to be a “non-allegation” and therefore closed and dismissed or whether it gets labeled as an “allegation” and transferred to another department for further research and review. A few changes to the criteria used to resolve and close complaints can determine whether regulators see a rise or fall in customer and employee complaints that are resolved.[62] Eliminating a key internal control group is a key indication of risk[63], particularly while research points to increased consumer complaints since the fake account scandal.[64]

Wells Fargo’s Consumer Complaints with the CFPB Have Grown Since 2018

Despite Wells Fargo’s claims that it has changed its culture, customer complaints to the Consumer Financial Protection Bureau (CFPB) against Wells Fargo continue to exceed those received prior to when the Federal Reserve imposed its order to restrict the bank’s growth.

The Federal Reserve Board of Governors’ February 2, 2018, order imposing limits on Wells Fargo’s growth contained various conditions that Wells Fargo must satisfy prior to the lifting of the order. These conditions include the development, adoption, and implementation of written plans and programs to comply with the consent orders issued by the OCC and the CFPB to remedy deficiencies in Wells Fargo’s management oversight of sales practices and risk management.[65] While these 2016 OCC and CPFB consent orders related to Wells Fargo’s retail sales practices have since been resolved, the volume of CFPB consumer complaints against Wells Fargo continues to exceed those received prior to the Federal Reserve’s 2018 asset cap order.

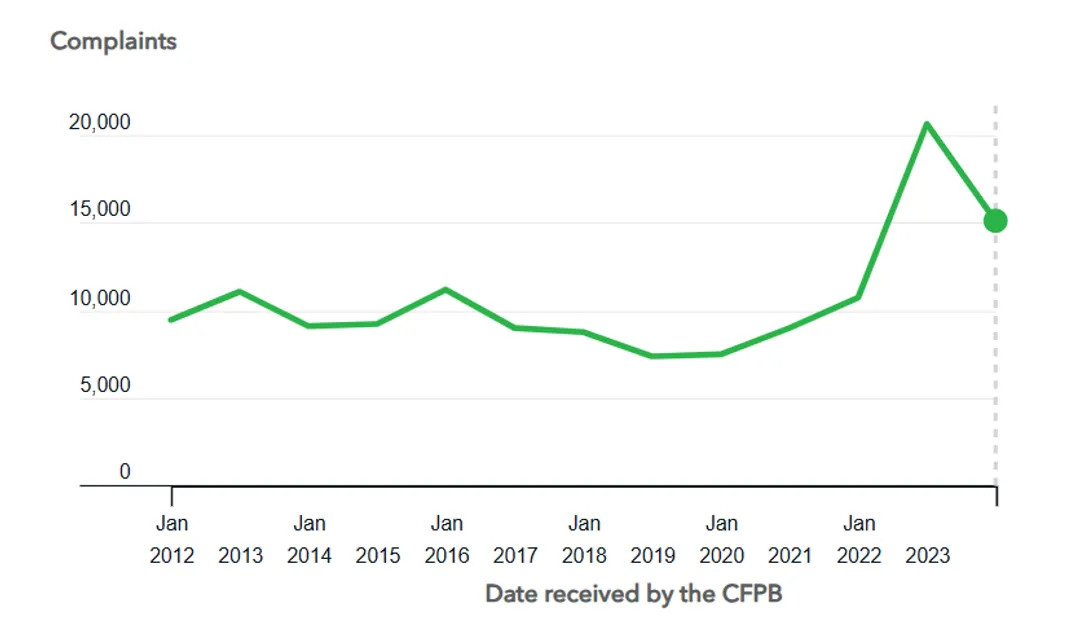

According to the CFPB’s Consumer Complaint Database, the number of annual consumer complaints against Wells Fargo fell modestly in 2019 and 2020 after the Federal Reserve asset cap order in 2018. However, the number of CFPB complaints received began rising in 2021, peaking in 2023 with 20,722 complaints filed. While the number of consumer complaints filed against Wells Fargo fell to 15,140 complaints in 2024, the CFPB still received approximately 50% more complaints against Wells Fargo in 2024 compared to the average number of CFPB complaints received between 2012 and 2022. This increased level of CFPB consumer complaints in 2023 and 2024 suggests that Wells Fargo’s sales practices continue to be an area of concern that the Federal Reserve needs to evaluate before lifting Wells Fargo’s asset cap.[66]

This connection is supported by information obtained from Investigators within Conduct Management. Investigators report they still regularly receive cases to review involving sales practice misconduct, unauthorized accounts, and sales pressure.[67] These cases include unauthorized accounts, sales pressure allegations, missing promotional cash bonuses due to misleading information about new deposits, unlawful vehicle repossessions, wrongful foreclosures, and the conversion of customer credit cards to higher-interest-rate products without consent.[68] An Investigator cited one recent case involving a customer complaint regarding a banker pressuring them to “upconvert” (i.e., upgrade) a checking account.[69] Further, a separate Investigator reported that Wells Fargo changed how sales practice misconduct cases are reviewed within the past 20 months, narrowing the scope of misconduct to account openings. Specifically, this Investigator asserted that senior leadership altered the definition of what constituted an allegation of misconduct in Conduct Management’s policies, procedures, and Allegation Decision Matrix (ADM). As a result, a case that was considered an allegation one month could be dismissed as a non-allegation the next month.[70] The result of these changes could be that regulators are seeing a decline in consumer complaints determined to be allegations. With layoffs and uncertainty about the future operations of the CFPB, regulatory oversight of potential sales practice misconduct may be hampered in the future.

Figure 1: Rise in Wells Fargo Consumer Complaints to the CFPB[71]

The following sections of this report will bring to light the current and ongoing concerns of frontline Wells Fargo workers, many of whose tenures predate the fake account scandals, and reveal how the bank’s flawed approach to human capital management is an ongoing risk for stakeholders.

Carrots, Sticks, and the Operational Basis for Good Jobs

All enterprises manage their workforce with a combination of beneficial rewards (“carrots”) and disciplinary sanctions (“sticks”). Generally in the U.S., workers without college educations face hierarchical workplaces where sticks predominate over carrots, while professionals enjoy workplaces with more consensual management and opportunities to share in the enterprises’ success. While increasing the role of incentive and commission pay could be part of an effort to improve job quality for lower-paid employees, the link between such pay designs and the enterprises’ operations is key. If incentives focus on overall success, set reasonable goals, and are supplemental rather than coming at the expense of guaranteed pay and benefits, in our view, they can plausibly lead to improved productivity and revenue. But if the incentives are narrowly focused on particular individuals, premised on unreasonable criteria, or substitute for guaranteed pay or benefits (even in the subtle sense that failing to hit an incentive may lead to loss of opportunities, discipline, demotion, or even termination), then increasing incentive and commission payments may undermine effective operations by forcing workers to take shortcuts and sacrifice service quality to keep their jobs.

Wells Fargo’s Flawed Approach to Human Capital Management

As noted above, Wells Fargo began to grow through large acquisitions in the late 1990s. The two most important mergers that produced today’s bank combined the original Wells Fargo with Norwest Corporation in 1998 and the Wachovia merger in 2008. Following each of these mergers, the Company made significant changes in its approach to managing its operations and investing in its workforce. Prior to the Wachovia merger, Wells Fargo did not rely heavily on commission and incentive payments to its employees. These pay components only comprised about 5% of overall non-interest expense in the late 1990s and rose only to about 10% prior to 2008.

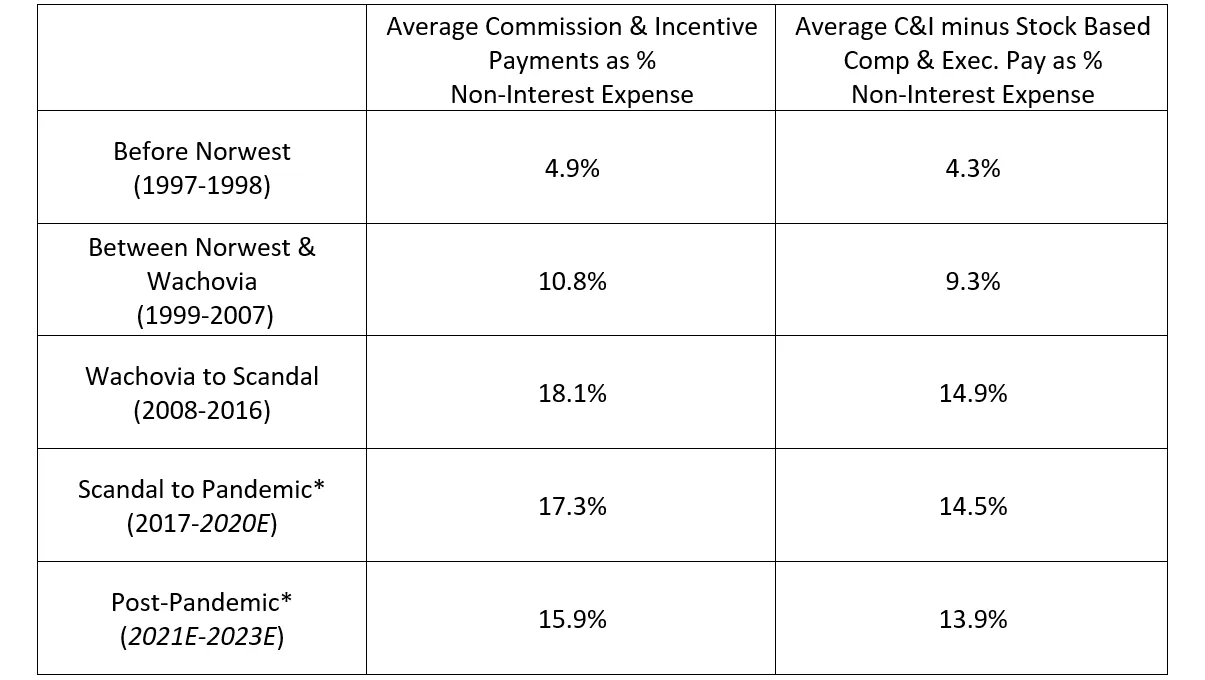

Table 1: Mergers’ Persistent Impacts on Incentive-based Compensation[72]

* Wells Fargo stopped reporting C&I payments after 2019. CBB estimates Commission & Incentive Payments from 2020 forward using the following regression model analysis: y= 3584.74+(1.64*SBC)+(42.4*EX PAY)+(0.07*Sum TTE & E). See note 4

But as Table 1 shows, the Wachovia merger had an immediate impact, roughly increasing commission and incentive pay to 67% on average as a proportion of non-interest expense, with the share increasing about 60% with executive pay and stock-based compensation excluded. The effect of the Wachovia merger persisted even after the revelation of the fake accounts scandal, with commission and incentive payments falling from 18.1% on average to 17.3% from 2017 to 2020 (2020 data estimated[73]). However, CBB estimates that since 2021, commission and incentive payments are showing signs of returning to levels seen before the scandal period, at an average of 15.9% as a proportion of non-interest expense.[74]

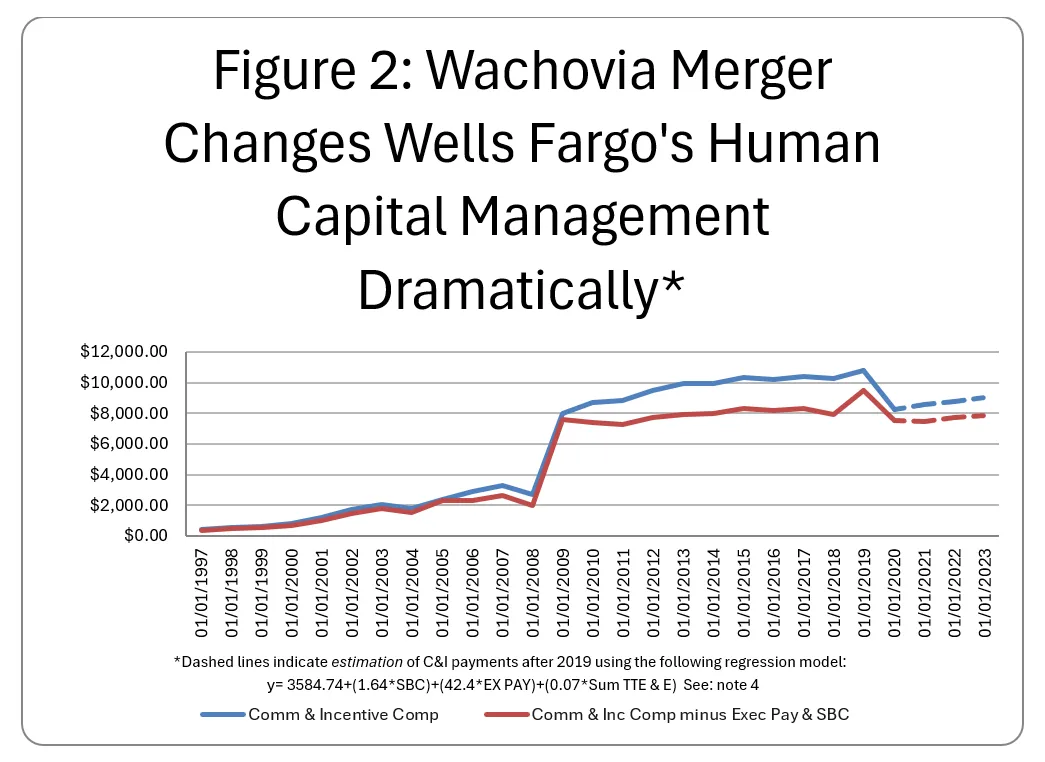

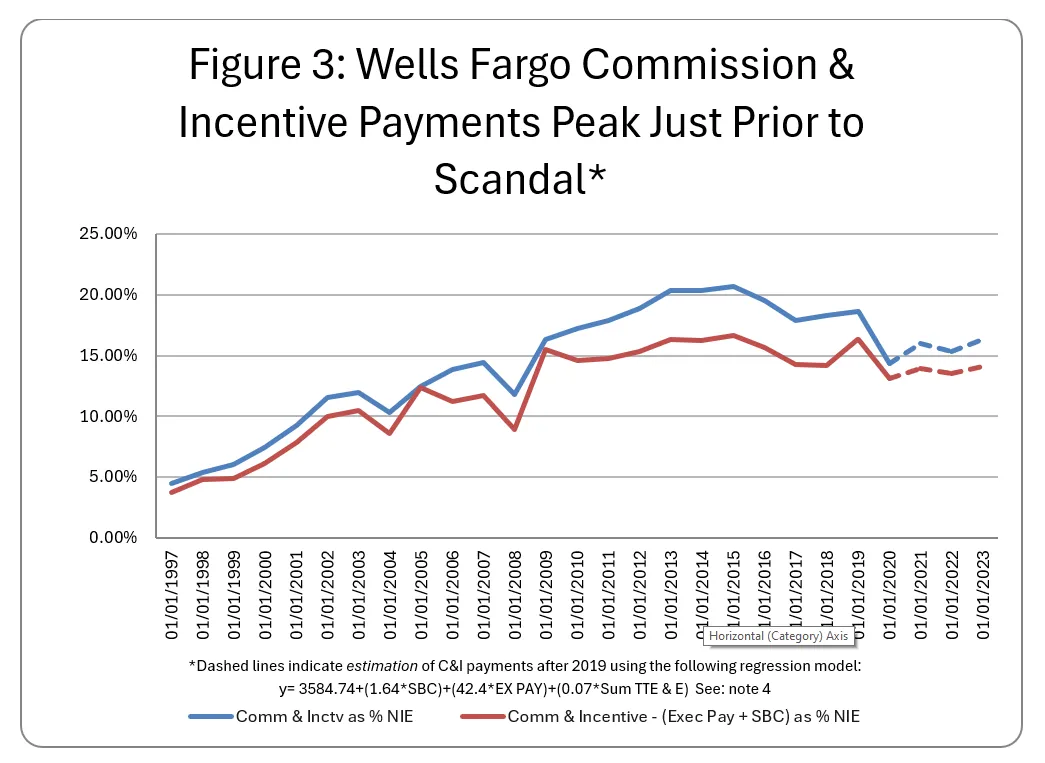

Figure 2 shows the post-Wachovia merger increase was particularly large in cash terms, with a sharp increase in 2009 that is only partly reversed during 2020.[75] Figure 3 displays the same data as a percentage of non-interest expense, which helps to emphasize that the long-term peak in Wells Fargo’s reliance on commission and incentive payments occurred during the years just before the fake accounts scandal was revealed and declined subsequently. [76]

Moreover, both Figures 2 and 3 show that Wells Fargo’s increasing reliance on commission and incentive payments was not a simple consequence of either increased pay for the top 5 executives or increased use of stock grants in compensation plans. Independent of those two factors, the red lines in both figures show a clear upward trend, especially following the Wachovia merger, peaking just as the fake accounts scandal began to unfold. Wells Fargo’s human capital management strategy in the post-Wachovia merger period clearly entailed greater reliance on incentive and commission payments to motivate the workforce and drive new revenue streams. The extensive reporting around the fake accounts scandal makes it clear that these incentives were premised on excessively demanding, individualized, and coercive criteria, exactly the opposite of how companies create good jobs and long-term-oriented businesses.

Despite the bank’s claims to have reformed, CBB estimates that the post-pandemic period has seen an increase in the weight of commission and incentive payments, such that by 2023 they had reached a level close to their peak in 2014. This recent increase in commission and incentive payments as a share of non-interest expense reinforces the concerns expressed by Wells Fargo employees that the company has recently been reverting to the high-pressure sales incentives that brought the bank low eight years ago.

Investment in Human Capital Management and ROI

Investors have developed quantitative tools to assess the efficiency and returns companies enjoy on their human capital investments. In a July 2023 research summary, Schroder Investment Management and the California Public Employees' Retirement System (CalPERS) outlined a number of approaches to quantifying the effects of human capital management on company bottom lines, including the metric Human Capital Return on Investment (“HCROI”).[77] The metric expresses the sum of an employer’s net operating profit after tax and total spending on employees (“Human Capital Cost Factor” or HCCF) as a percentage of its HCCF. Schroder and CalPERS found that HCROI has a positive and statistically significant relationship with forward returns over all time horizons and across all industries studied, taking into account a range of relevant financial variables including capital intensity, valuation, and return on capital employed.[78]

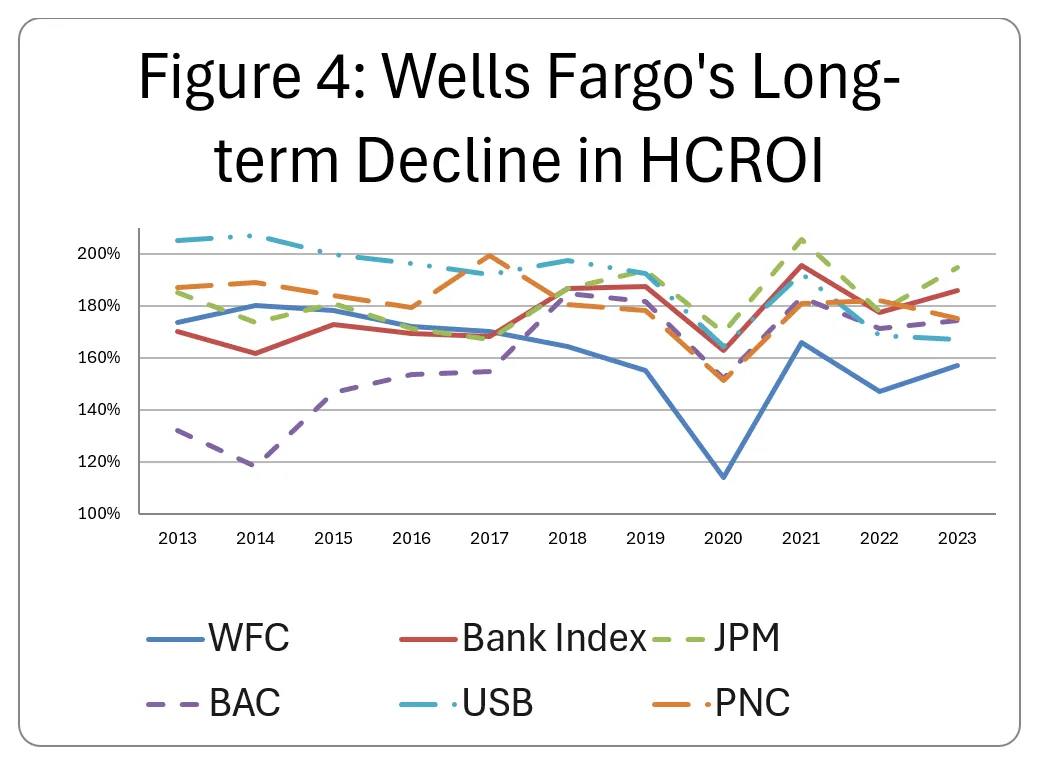

Figure 4 uses the Schroder-CalPERS model to compare Wells Fargo’s HCROI to those of its four largest competitor commercial banks, based on deposits, as well as to an index of those four banks weighted by market capitalization. While the regulatory restrictions placed on Wells Fargo limited their expansion, in practice Wells Fargo’s operating income grew at a similar rate to competitor banks such as Bank of America and U.S. Bancorp. Additionally, Wells Fargo sharply reduced employment (and thus Human Capital Management-related costs) after the fake account scandal, reducing FTEs (full-time equivalent employees) by 18% between 2017 and 2023. Consequently, we view Wells Fargo’s long-term HCROI decline as a meaningful indicator of management’s effectiveness in cultivating its workforce, rather than an artifact of regulatory limitations.

Plainly, Wells Fargo has been on a very different trajectory than its leading competitors. Since 2014, Wells Fargo’s return on its human capital spending has declined almost every year; after peaking at 180% in 2014, the bank's return fell to about 170% in 2016. This decline sharpened noticeably with the revelation of the fake account scandal in late 2016, with Wells Fargo’s HCROI falling further to 155% in 2019. Whereas Wells Fargo’s return on human capital investment equaled its competitors on average prior to 2017 (both posted a 175% HCROI from 2013-2017), since 2018, Wells Fargo averaged a 151% HCROI compared to an average of 182% for its competitor banks.

Wells Fargo Policies, Metrics, and Training Materials Confirm Return of Sales Goals

In 2016, in response to the fake account scandal, Wells Fargo instituted “Change for the Better,”[79] during which branch managers held multi-day events with their bankers and tellers to apologize for the toxic culture, unbearable treatment, and unattainable sales quotas. During these events, branch managers were instructed to tell employees that Wells Fargo would no longer monitor individual sales, there would be no more outbound sales calls to customers, and that they would never repeat the actions that caused the scandal.

Today, employees are given a different message: sales pressures are back and likely to increase.

On February 10, 2025, Mia Nicholls, head of Talent Management and Learning, sent an email to employees in sales activity roles with the subject line reading, “Goal Setting for Employees in Sales Activity Roles”. The message states,

Since you are in a sales activity role, your goals will be preset for you. Given the importance of sales activities to the company, your goals and your manager’s goals will be carefully assessed for risk, then approved. Once approved, your goals will be cascaded to you. You do not need to worry about entering goals at any point.

This process may continue into mid-April. Once you receive your goals, be sure to talk with your manager to understand priorities and discuss any changes in your role from the previous year.[80]

The problem, in our view, is that prior sales goals were developed by business leaders during the fake accounts scandal era. Former CEO John Stumpf established the “Eight is Great” mantra, not rogue local branch managers.[81]

Workers described branch manager metric dashboards and one-on-one metric and trends evaluations which further confirms the importance of sales goals, now labeled as “sales outcomes,” to employee performance. Instead of pushing “Eight is Great” sales quotas as Wells Fargo did prior to 2016, managers now refer to sales goals as “Behaviors” and “Outcomes.” “Outcomes” is management’s new terminology to refer to sales. All products, services, or other volume metrics sold to customers are “outcomes.” Branch managers are required to closely track “outcomes.” And employees are increasingly told they need more “outcomes.” Branch managers are provided with a dashboard that closely tracks a long and detailed list of “production outcomes,” including loan volume growth, compliance with sales tools, and their ranking compared to other branches in the same region.[82] For example, branch managers are required to track “new checking accounts per Banker FTE” and “new consumer and business credit cards opened per Banker FTE.”[83] Lower-volume branches could get flagged for the closing and layoff list[84], adding pressure on Branch Managers to push for an increase in sales from Bankers and Tellers.

Workers are Reporting Returning Sales Pressures at Wells Fargo

Results from a survey of Wells Fargo employees find overwhelming concerns about the return of sales goals and sales pressure. Corinne Jefferson, who is a Personal Banker at the Daytona Beach Branch where workers voted on January 11, 2024, to become the second unionized branch in the country, reported:

I’ve been a banker at Wells Fargo for over 14 years. I lived through the terrible years of extreme sales pressure. I have never had a write-up, even during the scandal, until we started organizing a union this past year. I was never investigated because I followed the law and did what was right for our customers, even though I suffered abuse by Wells Fargo. After the scandal broke, they made a big deal of “Change for the Better,” promising to never put inappropriate sales pressure on us again. Now if you ask a manager what happened to Change for the Better, they’ll respond, “That was before.” And me and my coworkers feel like Wells Fargo is just biding their time until regulators are looking the other way and they can go right back to what they have done in the past.[85]

Over the past 12 months, CBB has surveyed Wells Fargo employees—union and non-union—regarding their views on a range of issues including pay, layoffs, return to office policies, and whether there are concerns of sales pressure returning. To date, 241 workers located in 30 different states have responded to the survey—with the highest number of responses coming from workers in Arizona, California, North Carolina, and Texas. More than half of the survey responses, or 129, were from Bankers and Tellers in branches. The remaining respondents work in call centers or corporate offices in a variety of departments, including technology, software engineering, fraud claims, loan officers, customer service and account resolutions representatives, and administration.

CBB interviewed survey respondents and conducted additional interviews with workers regarding their concerns about the return of sales pressure. CBB also reviewed documents Wells Fargo provided to employees which impact their working conditions, including training material, new policy documents, employee metrics, and branch manager dashboards. Workers’ concerns regarding the return of sales goal pressures appear to be corroborated by these recent policies, training materials, and one-on-one evaluations workers are having with their managers. To protect workers from one of their top concerns—retaliation for raising concerns about working conditions—the identities of survey respondents are not provided.

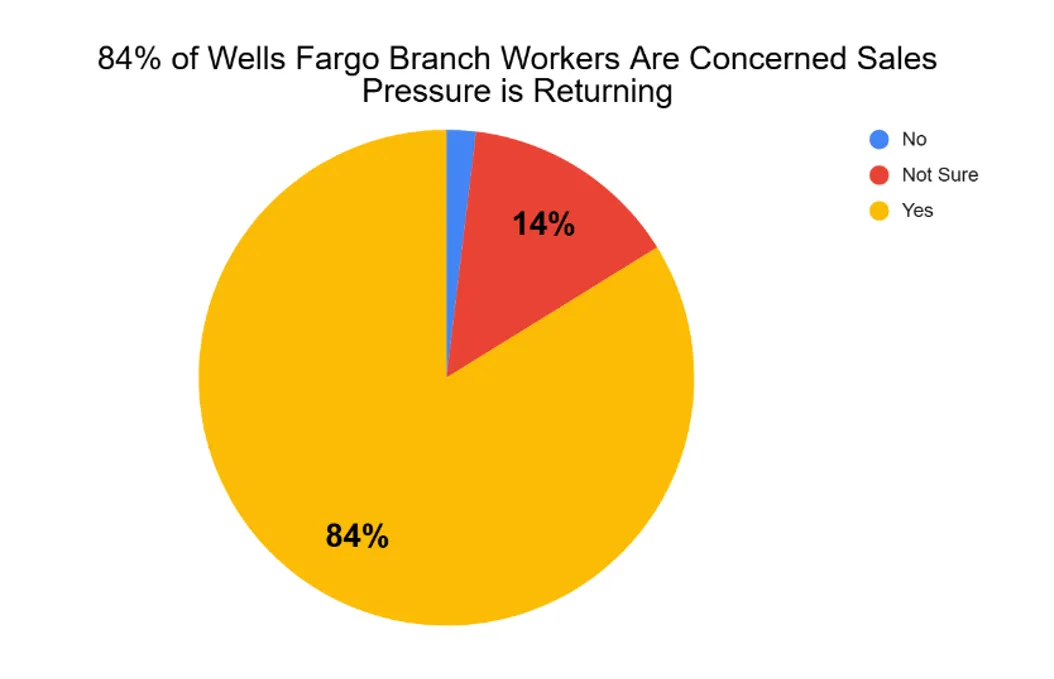

Overwhelmingly, the survey results paint a picture where workers in “sales activity roles” increasingly feel the work environment is reminiscent of the high-pressure environment in place during the 2016 fake accounts scandal. In response to the survey question, “Are you worried sales goal pressure is returning to Wells Fargo?” 84% of branch workers and 66% of respondents overall answered “yes.” Among branch worker respondents, 14% answered they were “not sure,” and only 2% answered “no.”[86]

Figure 5: Wells Fargo Branch Workers are overwhelmingly concerned about sales pressure returning[87]

In survey responses, workers provided additional comments illustrating how stressful the return of predatory sales goals and the ensuing pressures have been. This pressure to meet sales “outcomes” reflects a broader shift in how performance is measured, where the language may have changed, but the expectations remain the same. Tellers face pressure to meet metrics even though incentive pay tied to sales was eliminated for them after “Change for the Better.” As one worker confirmed, a big part of the Teller's role is to refer clients to Bankers, which leaves them feeling “required to get customers to agree to sit with a Banker.”[88] Each time a customer agrees to sit with a Banker, there is an opportunity for the Banker to earn compensation. A Teller in Texas reported that, “Every day I am asked to tell customers they need to meet with Bankers or financial advisors. Most of [them] decline, but I’m still pressured to ask again and again.”[89] Workers understand that the emphasis on “outcomes” has simply replaced “sales goals,” but it means the same thing.[90] An Associate Personal Banker in Nebraska emphasized, “They said no more sales goals, and now they are back but sugar coat the word ‘sales goals.’”[91] Similarly, a Senior Premier Banker with a 14-year tenure at a Wells Fargo branch in central Florida summarized, “I have seen some recent trends in the company that indicate we are returning to our sales-at-any-cost mentality. I have also seen good employees smeared by higher-up leadership because of personal vendettas.”[92]

A Personal Banker in Connecticut described the work environment: “They don’t care about us; they see us as disposable creatures. You’re worried that you might [not] have a job the next day. Sales goals are back; that’s all they talk about now.”[93]

In one-on-one meetings with their branch managers, Bankers were told that outcomes matter, regardless of whether workers meet all of the stated goals for their position.[94] A review of a standard one-on-one metrics evaluation for a Senior Premier Banker confirms how important sales-related metrics are. Performance evaluations emphasize “outcomes, progress, and performance,” the Next Best Conversation scores, and a new sales product called “EASE.” EASE stands for “Ensure the right products, Avoid unexpected fees, Share convenient services, and Empower financial goals.”[95]

When asked for more details on how they are noticing the returning pressure, workers reported a frustrating scene playing out with new products and tools.

Conversation Starters for Tellers: A customer who needs assistance managing their account walks into a branch and is directed to a Teller who can assist them. The Teller then proceeds to verify the customer’s identification and account information. Based on the customer’s profile, account activity, and transaction history, the Teller receives an orange-colored dialog box on their screen filled with prompts that flag products or services the customer does not have but may benefit from. This dialog box full of prompts is known as the Conversation Starter. The Conversation Starter is designed to encourage the customer to meet with a Relationship or Premier Banker who works on-site. Each time a Teller receives a Conversation Starter, they must review each prompt with the customer and record that they have successfully asked the customer each prompt from the dialog box. The customer can either decline or accept the invitation to meet with a Banker about a product or service mentioned by the Teller.[96]

Employees have reported that Branch managers closely monitor Tellers’ compliance with the Conversation Starter (also known as the Orange Button questions) by closely tracking referrals, even though they no longer receive incentives, which many Tellers feel is unfair.[97] Tellers described how they are evaluated, among other things, on the number of customers who are presented with a Next Best Conversation and Discover Needs assessment (discussed below).[98] Tellers describe being evaluated on the number of “Migratable Transactions,” the count of deposits that customers can complete via the mobile app or at an ATM without Teller assistance.[99] Scores on these metrics determine whether Tellers are eligible to receive raises, incentives, or bonuses. A Teller at a branch in Texas summarized their concern like this: “We know sales are coming back the way they are pressuring us with the referrals and the conversation starters.”[100]

Discover Needs and Next Best Conversation tools for Bankers: If a customer accepts the invitation to meet with a Banker and expresses interest in opening a new product, the Banker is required to engage in a highly scripted set of questions designed to pinpoint which set of products and services Wells Fargo could offer the client. These questions are referred to as conducting a “Discover Needs” assessment. Bankers are required to conduct a Discover Needs for every product discussed with a client, which can become very repetitive for both the banker and the customer. Following the Discover Needs assessment, Bankers also use the Next Best Conversation (NBC) tool, which identifies specific product offers for which the customer qualifies based on activity in their account, online, or at the ATM.

Compliance with the Discover Needs tool is used during performance evaluations and can have a negative impact.[101] If a Banker or Teller receives anything less than a “Meets Expectations” score (i.e., “Inconsistently Meets” or “Needs Improvement”), the worker will be disqualified from receiving annual raises, incentive payments, and bonuses.[102] Customers can decline to answer the Discover Needs questions and still get the financial service or product (i.e., open a checking account). But every time a customer declines, it will hurt the Banker’s compliance record with Discover Needs. Further, workers assert that there is no written policy regarding compliance with the Discover Needs tool, making it impossible for them to know how to meet expectations or at what point they will be issued a warning or receive coaching. In addition, workers allege that compliance with the Discover Needs tool has been used to retaliate against workers for exercising their right to form a union.[103]

Nevertheless, without clear compliance metrics, managers have great discretion to decide when to give a negative risk overlay to any Banker based on their Discover Needs score. In other words, without a written policy, Discover Needs compliance could be used to mask a sales agenda.

A Teller in the Houston, Texas, area described how these tools feel designed to reinstate sales pressure:

[T]he Tellers and Bankers are both being made to have forced conversations from the behavior framework. The NBCs (Next Best Conversation) tool to help refer customers to a Banker is very hypocritical and backwards. They want us to “be genuine” and “actively listen,” but then give us a literal script of how to refer them to the Bankers. There is pressure from management to have these conversations and get the Banker referrals. It feels like it’s beginning to create the toxic “sales” environment that Wells Fargo was trying to get away from due to the scandal. There are coachings on how to get [customers] from “not interested” to a referral. They are calculating all the numbers for the referrals, transfer rate, and more.[104]

Another branch employee in Texas reported they feel forced to “keep asking [customers] whatever the Next Best Conversation prompts us [to]. All that counts is knowing we are directing them to the right person. It feels like back then [in 2016].”[105]

In general, workers express frustration and cite a lack of transparency over how they are evaluated. An Associate Personal Banker in the Washington, D.C., metro area provided this experience:

I performed well, received commendations from a fill-in Roving Bank Manager, District Manager, and a returning Bank Manager. However, a manager that had previously covered the branch gave me a NEEDS IMPROVEMENT RATING, which prevented me from receiving the $1,100 [cash bonus], and it prevented me from receiving a quarterly incentive bonus of almost $1,000.[106]

Outbound Calls Return: Outbound calls were supposed to be eliminated under the “Change for the Better” initiative. During the fake accounts era, mandatory outbound “call nights,” where workers would call customers to sell them additional products in an attempt to meet unrealistic sales goals, were routine. If workers did not meet their goals, they would often be forced to work overtime without pay.[107] Outbound calls were reintroduced during the COVID-19 pandemic, when calls became an essential way for Wells Fargo to maintain relationships with clients when in-person visits were limited due to masking and social distancing requirements.

However, over the past two years, Bankers have observed significant shifts in the frequency, purpose, and structure of outbound calls. Bankers are now given lists of customers to call to get them to make appointments regarding specific products.[108] Customers are targeted based on their existing accounts —such as retirement, checking, or savings accounts—and recent activity, like significant balance changes. A Banker in the Charlotte, N.C., area reported that last year, employees at their branch were instructed to call and encourage customers to “come in on occasions because there is a product that Wells Fargo feels [the customer] can benefit from.”[109]

Now, compliance with outbound call protocols is tracked alongside other sales tools like Discover Needs and Next Best Conversation. Among the “Banker Effectiveness Metrics” are “Outbound Metrics,” which include tracking the number of outbound calls each Banker makes where the Banker spoke with the customer. The number of appointments each Banker is able to schedule with customers is also tracked.[110]

Sales Pressure is Compounded by Severe Understaffing and Other Sources of Stress

Survey responses reveal how severe understaffing levels are a constant source of stress for the vast majority of workers in branches across the country. Workers from Florida to Arizona to Alabama report they routinely experience lines of customers waiting to meet with a Banker or Teller extending out the doors of their branches.[111] Workers in Arizona and California also report their workloads have increased with extra operational tasks that were previously done by managers.[112] Further, workers report being pulled away from serving customers in order to perform control and audit functions. For example, a Teller in New Mexico reported having to leave the lobby, drive-thru, and commercial lanes unattended because of short staffing,[133] while a Banker in Florida reported having to leave a customer who had an appointment at their desk in order to approve overrides or get money out of the vault or help the Teller line.[114] Some Bankers are also cross-trained so they can work as Tellers as needed, which causes additional stress. The stress from sales pressure and understaffing caused a Teller in Virginia who has worked for Wells Fargo for 18 years to take disability leave.[115]

Meanwhile, workers have also identified cuts in service that aggravate customers and contribute to poor reviews. One worker in Arlington, Texas, reported Wells Fargo is “closing the drive-thru at our location, and many customers are NOT happy about the decision. It’s due to ‘trends in drive-thru,’ corporate speak for ‘we are not that busy.’ [But] about 30% of our traffic is drive-thru, and many of our customers who use the drive-thru have trouble walking.”[116]

A branch in Alabama reported having inexperienced managers who are unable to support or positively coach staff and instead require support from already overworked bankers and tellers.[117]

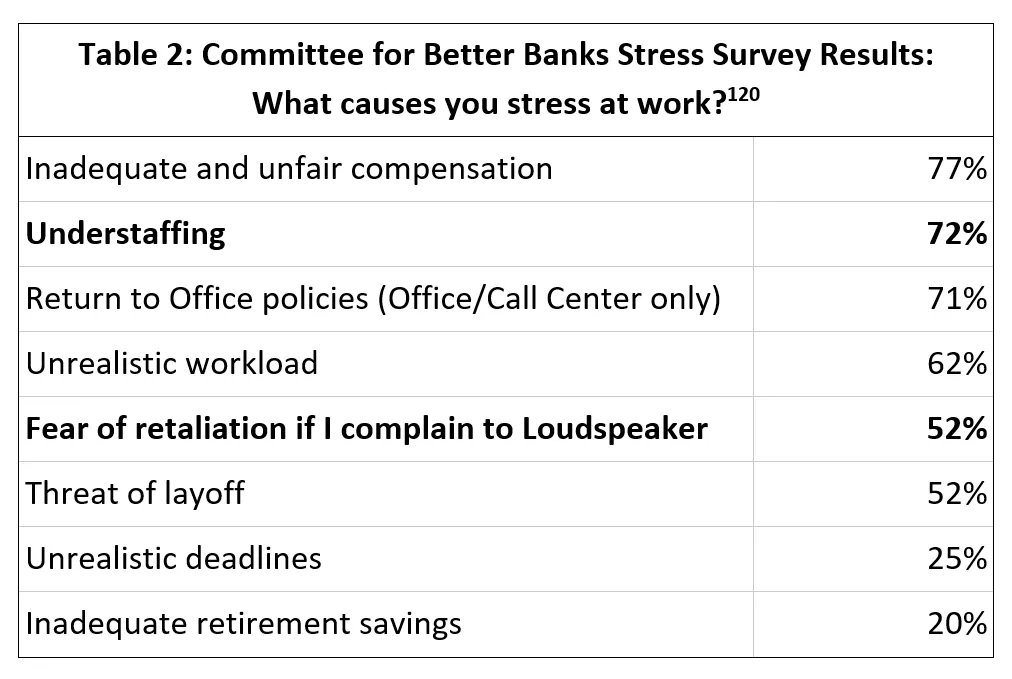

Given these conditions, the survey results are not surprising: 72% of survey respondents identified understaffing as a major source of stress amid the return of sales pressure.[118] Understaffing can result in bankers cutting short their meeting with a customer because they have another appointment waiting, which can result in poor customer reviews.[119] Despite these widespread concerns, many workers fear retaliation for speaking out about the impact of understaffing. 52% of survey respondents expressed concerns about reporting potential regulatory violations to the Ethics Line, Wells Fargo’s internal hotline. The combination of severe understaffing and the return of intense sales pressure, along with the concern about reporting regulatory violations, poses serious risks that could have alarming consequences.

A call center financial advisor in Utah responding to the survey put it succinctly:

The reduction in internal controls (understaffing, undertraining of the support staff, lack of written policies, lack of a central planning unit to coordinate company policy implementation, etc.) is creating a high-stress environment and an opportunity for another scandal.[121]

Workers expressed frustrations from their concerns being ignored and their immediate managers being powerless to make any changes. An Associate Personal Banker in Pennsylvania commented:

It seems like all Loudspeaker suggestions about the staffing model get passed back down to local management, and the branch managers just get coached on how to make a schedule according to the cloud cords model.[122]

Finally, in letters signed by branch workers and delivered to managers announcing their intention to form a union, the stress from understaffing and its connection to sales goals and poor customer reviews is repeatedly cited as a key motivator. An excerpt from the letter that the team at the National City, Calif., branch delivered to their branch manager on April 3, 2024, is typical of many of these “union announcement” letters:

We strive to meet the ideals of Wells Fargo while providing [customers] with a friendly and welcoming atmosphere. However, in recent years, the ability for us to provide this level of service has been seriously strained by policies put in place by executives who have never stepped foot in our branch. With our decreasing staffing levels, we are left disappointing our customers with long wait times and limited appointment availability. Bankers have to increasingly spend large amounts of time helping out on the Teller line while helping a customer, hindering the ability to focus on the client in front of them. Tellers are expected to cover the work of two or three Teller positions while constantly being left without management and being put in a forced management role. These increased workloads have left the employees feeling physically and emotionally drained and pushed beyond our limits…Although the message from the executives is that we do not have production-based goals, this is not the case in the field, with leadership giving us production quotas that ‘must be met.’ While being told to offer knowledge, we are aware it is sales tactics disguised as information, all while the Bankers are then told to offer more products to meet their metrics. If these quotas are not met, employees who receive compensation have been told it will be decreased, while others have been told there will be consequences. These tactics result in dissatisfaction amongst our customers, [who] voice their dissatisfaction through complaints and NPS [i.e., customer] surveys, and their feedback is often used against us instead of providing the needed changes.[123]

The mental load is taxing for workers who have remained loyal to Wells Fargo. One worker in North Carolina with 15 years of service at Wells Fargo reported:

[I had a] breakdown at work because I could not mentally handle the overwhelming workload and extreme understaff[ing], and the fact that they even refused to acknowledge it and tell us that we're fully staffed is the worst part. As though we don't know how many people we need. I've worked in the same Branch for the last 13 years, and I know how many people we need to operate properly. They hired shoddy management that came in and wrecked our branch, then proceeded to fire the manager, which was then followed the next day by our BCR, which we failed for the first time ever since I've worked for the company. Now there is more new management who knows nothing, and they're constantly asking me for things because of my tenure, even though they see how much pressure I'm under running the drive-thru alone, working all the night drop bags alone, and then being asked to do a million other things. I went from having anxiety to having severe panic disorder, and I am currently out on disability because of it. I can barely leave my house. I cannot believe the circumstances that I was working under; I kept thinking it would get better, but it just keeps going down the toilet all while upper management tells us everything is fine and we're fully staffed. They think we're stupid. But because I've worked there for 13 years, I just keep staying. I've given so much time to this company and my job is important to me.[124]

Anti-Union Activity at Wells Fargo

Wells Fargo workers have won 28 union elections[125] since December 20, 2023,[126] across 27 branches located in 14 states, and have successfully organized members of the company-wide Conduct Management Intake Department, which consists of Investigators who review employee and customer complaints.[127] The NLRB has scheduled two more elections at branches in California.

The pace of workers winning union elections would be exponentially faster if Wells Fargo had not invested heavily in an aggressive anti-union campaign. In addition to training managers to communicate only negative information about unions to employees, management has been accused of repeatedly violating workers’ rights by engaging in coercive and retaliatory disciplinary actions against workers exercising their right to form a union. The pattern, scale, and severity of alleged violations underscore how Wells Fargo is willing to take great operational risks in order to suppress workers’ freedom of association.

The starkest example of Wells Fargo’s allegedly unlawful actions took place at the Atwater Branch in California, where every worker in the branch signed and delivered a letter to their branch manager on December 8, 2024, requesting that Charlie Scharf voluntarily recognize their union. Instead, the branch manager responded by allegedly imposing onerous working conditions, creating an impression of surveillance, and threatening changes to their working conditions. As a result, a majority of workers voted against unionization at an election conducted on January 18, 2024. Prior to the vote, CWA filed Unfair Labor Practice (ULP) charges with the National Labor Relations Board (NLRB) on behalf of the workers at the Atwater Branch alleging that Wells Fargo had engaged in brazen unlawful conduct that intimidated workers from voting yes.[128]

It took over a year for the NLRB to conduct its investigation into the ULP charges. In February 2025, after a thorough investigation interviewing witnesses and collecting documents and copies of text messages and emails, the NLRB issued a formal Complaint, finding merit in the allegations that Wells Fargo illegally threatened and retaliated against workers at the Atwater Branch in the lead-up to their union election. According to the Complaint, the branch manager told staff she knew an employee had been talking to co-workers about organizing and that the company would be watching them via camera. She also allegedly told employees that if they were going to be involved with a union, the company would stop being lenient with them and would make them stay at work longer.[129]

The remedy the NLRB is seeking at a hearing scheduled for October 21, 2025, before an Administrative Law Judge (ALJ) will “[require] that [Wells Fargo] recognize the Union as the exclusive collective-bargaining representative of the Unit and bargain collectively with the Union as the exclusive representative of the Unit, starting from December 8, 2023, and continuing until the parties reach an agreement.”[130] For context on the likelihood of success, while in 2023 NLRB Regions found merit in only 41.1% of ULP charges filed, the NLRB Regions prevailed in ALJ proceedings in 90.9% of cases.[131]

Another stark example of Wells Fargo engaging in intimidation and delay tactics designed to frustrate workers and make them feel like their efforts are futile is its recent objections to the NLRB Region 18 certification of the election win by the investigators in the Conduct Management Intake Department. On December 2, 2024, the Regional Director for NLRB Region 18 (Minneapolis) certified the election results of ballots counted on November 1, 2024, which resulted in 21 employees voting in favor of union representation and 16 employees voting against. Wells Fargo had challenged the ballots of 8 employees whom they had laid off prior to the election, arguing that their ballots should not be counted. After the election, CWA dropped its objections regarding counting the ballots of the laid-off workers and agreed with Wells Fargo’s position to not count the ballots. Wells Fargo then asked for the full NLRB in Washington, D.C., to review the certification of Region 18 and has refused to recognize the certification of the election. CWA has filed additional ULP charges against Wells Fargo for refusing to bargain with the certified union.[132] On March 11, 2025, the NLRB issued an Order denying Wells Fargo’s request for review.[133]

As of the writing of this report, CWA has filed 33 Unfair Labor Practice (ULP) charges[134] against Wells Fargo at 26 separate locations, including at 18 separate branches. A majority of the charges occurred during the run-up to union elections, but a growing number are occurring after union elections as well. The ULP charges accuse Wells Fargo of a variety of violations of the National Labor Relations Act (NLRA), including unlawfully interrogating workers regarding their union activities, imposing discipline as retaliation against workers engaged in union organizing activities, and even illegally terminating their employment.

In two of the first ULP cases filed, which involved call center workers, Wells Fargo entered into formal settlements after the NLRB regional offices in Denver, CO and Seattle, WA determined there was merit to the allegations that the bank violated federal labor law by restricting employees from distributing pro-union literature.[135] In May 2023, Wells Fargo settled a case involving workers at a Salt Lake City call center who accused Wells Fargo of coercing employees who engaged in lawful distribution of pro-union materials to non-work areas.[136] In December 2023, Wells Fargo settled a case involving workers at an Oregon call center after managers not only required prior approval for pro-union materials but also removed them from non-work areas.[137]

Wells Fargo’s pattern of labor law violations has caught the attention of lawmakers who have sent letters alerting bank regulators. In October 2023, U.S. Senator Sherrod Brown (D-OH), who was Chair of the Senate Banking Committee at the time, raised concerns about unfair labor practices at Wells Fargo in a letter to Federal Reserve Vice Chair Michael Barr and Acting Comptroller Michael Hsu. The letter outlined several allegations in ULP charges filed against the Bank and urged regulators to “take stronger actions to change Wells Fargo’s culture of noncompliance.”[138] Since Senator Brown’s letter, an additional 22 ULP charges have been filed by CWA.

On August 13, 2024, U.S. Representative Melanie Stansbury (D-NM) authored a similar letter signed by 23 Members of Congress to Barr and Hsu, arguing, “There have been numerous [charges] filed citing the failure to respect workers’ protected right to freedom of association and collective bargaining. The lack of regard for this right not only puts the thousands of frontline workers at risk but also the soundness of Wells Fargo. Wells Fargo has demonstrated by their behavior that the safety and care of their workers is not a priority in the bank's functions.”[139]Repeated allegations of labor law violations and the growing scrutiny from lawmakers highlight a troubling pattern at Wells Fargo—one that not only undermines workers’ rights under the NLRA but should also raise doubts about the bank’s commitment to ethical business practices. Lifting federal restrictions in light of these allegations would be a grave mistake.

Wells Fargo Has Diverted Significant Company Resources Into Its Anti-Union Program

Two years ago, Wells Fargo devoted virtually no resources towards preventing employees from forming or joining a union. Prior to the first union election victory on December 20, 2023, there had never been a formal attempt by Wells Fargo employees to form a union in the bank’s entire history, dating back to its founding in 1852.

The drive among workers to organize a union at Wells Fargo has been building for a long time. According to multiple government reports related to criminal and civil investigations into the sales practice misconduct, employees had been filing internal complaints from 2002 through 2016 regarding sales integrity violations. Senior management was well aware of these complaints but largely ignored them.[140]

After a new CEO took the helm, claiming the high sales pressure environment was nearly fixed, workers continued to raise concerns that the toxic culture had not sufficiently changed, even briefing Federal Reserve Board Governors that helped push out the replacement CEO.[141]Successive CEO changes still did not result in meaningful improvements to working conditions.

Beginning in 2022, a growing number of workers announced efforts to organize the first union at Wells Fargo.[142] Jessie McCool, a Senior Compliance Officer in St. Louis, Mo., who helped form the first union organizing committee, stated, “If it’s left to the senior leadership, the changes won’t occur. So we have to collectively bargain and take control ourselves.”[143] Workers also recognized that forming a union would protect and improve their ability to better serve customers’ best interests. Ted Laurel, an Account Resolution Specialist in San Antonio, Texas, added, “We want the customer base to know that we’re forming a union really for them. We’re tired of having our name dragged through the mud at Wells Fargo because of things that we’ve asked to have more control over, but the company refuses to give us that control.”[144] Jessie, Ted, Corinne, and their colleagues recognize that the safety and security of the American financial system depend on a workforce able to perform their duties without stress, burden, or threats of losing their jobs, and when those protections are not offered, they should be able to exercise their right to join a union.

In April 2023, internal documents obtained by Bloomberg revealed that Wells Fargo executives were closely monitoring employee organization efforts and beginning to privately worry that a union “resurgence” could reach the bank next.[145]

In August 2024, Wells Fargo created a new position within its human resources department to oversee its anti-union efforts and hired Stan Sherrill,[146] who had previously spent nine years at the notoriously anti-union law firm, Littler Mendelson (now Littler). Sherrill has hired several staff members in this new unit, as well as hiring his former employer, Littler, as a consultant. In fact, a senior partner at Littler, Tanja Thompson,[147] is the point of contact for CWA and to date has chaired all of the collective bargaining sessions. Shortly after being hired, Thompson’s profile was altered on Littler’s website to remove her union-busting experience. Specifically, the following sentence was removed:

“Tanja’s union-free efforts include representing clients in traditional and corporate campaigns, comprehensive union vulnerability assessments, and detailed communication strategies, as well as developing and conducting engaging union avoidance and positive employee engagement training.”[148]

After Sherrill and Thompson were hired, Wells Fargo created an internal website for employees filled with negative information regarding unions. They implemented a standard “anti-union playbook” that is commonly used by employers to dissuade workers from forming unions.[149]Workers describe how their branch managers are instructed to deliver anti-union talking points during their weekly staff meetings. Many workers are aware that their managers are provided identical “Huddle Guides” by their superiors to ensure that every branch receives the same anti-union message. Workers in union branches are aware their managers participate in regular meetings with other managers to discuss topics on how to weaken and discourage further unionization.[150]

Immediately after workers deliver a letter signed by a majority of the workers in their branch demanding that Wells Fargo voluntarily recognize their union (while simultaneously filing for a union election with the NLRB), Wells Fargo management immediately embarks on a fierce anti-union campaign designed to intimidate workers, instead of respecting their right of freedom of association by voluntarily recognizing their union. During the month-long run-up to every union election, Wells Fargo has deployed a team of high-level managers plus staff from Sherrill’s department to descend into the location. Once on-site, upper management and attorneys hand out scores of anti-union fliers to employees and engage workers in one-on-one “captive audience” meetings where managers interrogate workers about their views of unions and repeatedly solicit workers to ask questions about unions so that management can deliver anti-union talking points.

After filing for a union election, workers are inundated with leaflets filled with misleading information about strikes and union dues.[151] Managers claim that “the union is a third party, so you won’t be able to work with us directly anymore” and “things are going to get ‘weird.’” Upper-level managers whom the workers have never met before take them into private offices and ask questions that feel very intimidating. Workers report being told things like, “Think about how this will affect your family” and “We really don’t want you to do this.”[152]

Some managers have gone further and allegedly “removed the schedule and lunchtime flexibility from all [workers]” in a branch immediately after workers filed for a union election, allegedly causing at least one worker to recant their support for forming a union.”[153] One District Manager even allegedly reacted to workers filing for a union election by not only declaring that workers’ “schedules will be different because of the union, [but] other employees will not want to work there because of the union and [they] will have caused all of this to happen.”[154]

Heavy surveillance and the practice of pulling workers into one-on-one meetings have only exacerbated the real problem of understaffing. Instead of serving customers, Tellers and Bankers are pulled off the floor sometimes for an hour and subjected to anti-union rhetoric and misinformation. This routine has played out during each of the 30 union elections to date.[155]

Conclusion

Wells Fargo employees are increasingly reacting to the bank’s approach to human capital management by exercising their right to freedom of association. Eight years after the revelation of the fake account scandal at Wells Fargo, it appears that the company has not done nearly enough to address the deficiencies in its approach to human capital management and, if anything, has recently been relapsing into the bad habits, misguided policies, and practices that brought the company low in 2016. This is not the first time since the fake account scandal broke that Wells Fargo executives have been accused of painting a rosier picture than employees experience day-to-day at work.[156] The combination of increased reliance on incentive and commission payments, a rise in customer complaints to the CFPB, employee reports of returning sales pressure, complaints about understaffing, and managerial opposition to union organizing all suggest that even under its third CEO since the scandal, Wells Fargo has neither learned nor changed enough.

The continued lack of proper human capital management could have dire consequences for Wells Fargo and the broader U.S. financial system. To rectify and right these wrongs, policymakers and the public must take seriously the need to hold Wells Fargo accountable for not allowing workers the free and fair choice to join a union. We must work together to ensure that Wells Fargo is held accountable by regulators and that the Federal Reserve and the Office of the Comptroller of the Currency continue to investigate their sales practices and maintain the asset cap until the bank has demonstrated that there are sufficient safeguards in place for protecting customer safety and financial security, including by recognizing the collective bargaining rights of its frontline workers, who are often the first to recognize and sound the alarm when there are issues impacting clients.

If regulators give Wells Fargo a clean bill of health under these circumstances and remove the remaining regulator limits on its business activities, the Committee for Better Banks believes the risk of a return to non-compliant practices is unacceptably high. Instead, regulators should specifically require Wells Fargo to recognize the value of its own workforce as an “internal control” that can alert senior executives, the board of directors, and key bank regulators if non-compliant practices are recurring. Moreover, by making pay practices subject to the consent of bank employees, collective bargaining at Wells Fargo promises to substantially mitigate the risk of such a return to bad practices and substantial losses of the past.

End Notes

Executive Summary

[1] Since 2000, Wells Fargo has paid over $27 billion in penalties. The sum of penalties since 2015 exceeds $14.8 billion. See: Good Jobs First. Violation Tracker. Wells Fargo & Company Summary. Accessed on February 26, 2025. https://violationtracker.goodjobsfirst.org/parent/wells-fargo; See Notes 4; 13; 18; 33; 34; 50; 53; 75; 95; 100 and 148.

[2] Emily Flitter, "The Price of Wells Fargo’s Fake Account Scandal Grows by $3 Billion", The New York Times. February 21, 2020. https://www.nytimes.com/2020/02/21/business/wells-fargo-settlement.html

[3] Consumer Financial Protection Bureau (CFPB). Consumer Complaint Database. 2012-2024 Wells Fargo & Company complaints received (accessed on February 14, 2024) https://www.consumerfinance.gov/data-research/consumer-complaints/search/?chartType=line&company=WELLS%20FARGO%20%26%20COMPANY&dateInterval=Year&date_received_max=2024-12-31&date_received_min=2011-12-01&lens=Company&searchField=all&subLens=product&tab=Trends

[4] Wells Fargo reports Commission & Incentive payments in its banking regulatory filings as well as in its 10K from 1997 to 2019. Wells Fargo stopped reporting Commission & Incentive payments after 2019. For years 2020 and after , we estimated Commission & Incentive payments based on a regression analysis of the components of Non-Interest Expense reported continuously from 2009 to 2023. This analysis yielded the following model: y=3584.74+(1.64*SBC)+(42.4*EX PAY)+(0.07*Sum TTE & E) where “SBC” is Stock Based Compensation, “EX PAY” is Executive Pay and “TTE & E” is Telecommunications and Equipment. *Note, estimated figures after 2020 are indicated with a dashed line.

[5] Committee for Better Banks. (2024) Worker Stress Survey. Tabulated Survey Results

[6] Goal setting for employees in sales activity roles, a message from Mia Nichols, head of Talent Management and Learning at Wells Fargo. Correspondence sent to employees in sales activity roles, February 10, 2025

[7] Committee for Better Banks. Email correspondence with a Banker in Wilmington, DE. March 10, 2025

[10] See note 5; Wells Fargo Workers United (WFWU), 2025, April 3. Letter addressed to Wells Fargo CEO Charles Scharf signed by 6 employees at the National City, CA branch.

[11] Between 2023 and 2025, Wells Fargo employees have received various leaflets, correspondence, memos and other information related to organizing at Wells Fargo: A Message from Saul Van Beurden and Colleen Canny, dated November 22, 2023; Information and Next Steps Regarding Union Petition; Audit the Facts; Eldorado - Are You the Catch or Are You The Bait?; Reconciliation Station - Union statements: do they add up?; Who's Pulling the Strings - Behind Wells Fargo Workers United and the Committee for Better Banks?; Be Informed - Notice of Petition: Correspondence from International Speedway Branch Manager; Huddle Guide dated May 2, 2023; How Could the Union Spend Your Money; Breaking Up Aint Easy to Do; Stronger as One Team (2024); You Can't Date the Union; Important Branch Update - Correspondence from Colleen Canny; What We Can Say vs. What the Union Can Say; Union Basics: Dues (Stronger as One Team, 2024); Under Pressure; Huddle Guide, dated May 16, 2023; Who Really Gets Hurt by a Strike at Wells Fargo?? - Correspondence provided to employees at the National City Branch; The Union: It Isn't All Fun and Games; Some Questions You May Want to Ask the Union - Correspondence provided in advance of a representation vote at the Prospect, Connecticut Branch; See: "Stan Sherrill". Accessed on 2/26/2025. LinkedIn. https://www.linkedin.com/in/stan-sherrill/

[13] Chris Prentice, Pete Schroeder, Imani Moise, "Wells Fargo to pay $3 billion to U.S., admits pressuring workers in fake-accounts scandal", Reuters. February 21, 2020. https://www.reuters.com/article/business/wells-fargo-to-pay-3-billion-to-us-admits-pressuring-workers-in-fake-account-idUSKBN20F2KM

[14] U.S. Department of Justice. (2020, February, 21) Wells Fargo Agrees to Pay $3 Billion to Resolve Criminal and Civil Investigations into Sales Practices Involving the Opening of Millions of Accounts without Customer Authorization. [Press Release]. https://www.justice.gov/archives/opa/pr/wells-fargo-agrees-pay-3-billion-resolve-criminal-and-civil-investigations-sales-practices.

[16] U.S. Office of the Comptroller of the Currency. In the Matter of Wells Fargo Order Terminating the Consent Order. (2024) Docket Number: AA-ENF-2024-11. January 30, 2024. https://occ.gov/static/enforcement-actions/eaAA-ENF-2024-11.pdf

[17] Nupur Anand, "Exclusive: Wells Fargo asset cap likely to be lifted next year, sources say", Reuters. November 26, 2024. https://www.reuters.com/business/finance/wells-fargo-asset-cap-likely-be-lifted-next-year-sources-say-2024-11-26/

Introduction

[19] John Heltman, "Fed drops hammer on Wells Fargo as four board members ousted", American Banker. February 2, 2018. https://www.americanbanker.com/news/fed-drops-hammer-on-wells-fargo-as-four-board-members-fired ; Jennifer Liberto, "Wells Fargo CEO Quits In Wake of Consumer Financial Scandals", NPR. March 28, 2019. https://www.npr.org/2019/03/28/707738077/wells-fargo-ceo-quits-in-wake-of-consumer-financial-scandals ; Report by Majority Staff of the Committee on Financial Services, U.S. House of Representatives, “The Real Wells Fargo: Board & Management Failures, Consumer Abuses, and Ineffective Regulatory Oversight,” March 2020, at 22,

https://democrats-financialservices.house.gov/uploadedfiles/hhrg-116-ba00-20200310-sd003.pdf ; Renae Merle, "Wells Fargo Board Members Resign After Scathing House Report", The Washington Post. March 9, 2020. https://www.washingtonpost.com/business/2020/03/09/wells-fargo-board-members-resign-after-scathing-house-report/